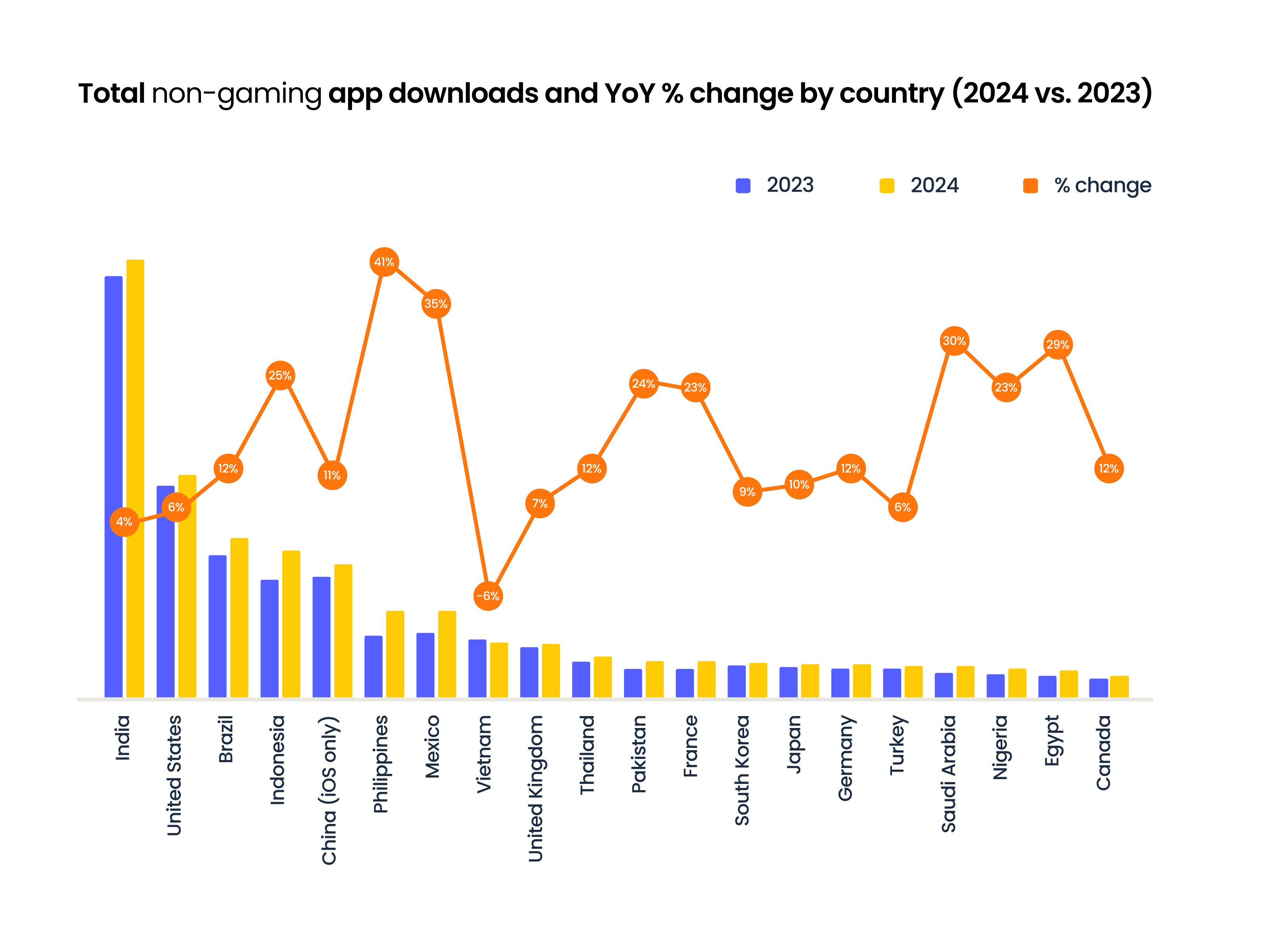

Generative AI tools have become a part of our lives now, and they have also incorporated themselves into the mobile advertising industry. The advertising industry is seeing a noticeable growth in social media and video streaming, but the gaming industry is still dominant. The 2025 App Marketer Survey Report by Liftoff found some key stats that tell us that industry performance is going to improve in 2025. Non-gaming apps saw a 12% increase year-over-year in their downloads, while overall app categories saw a 7% increase. 4.2 trillion hours were spent by users globally on different apps in 2024, which is about 500 hours per person.

As app time increases, developers are also seeing an increase in revenue. The consumer spend on non-gaming apps was $3.5 billion in 2014, which increased to $69 billion in 2024, and saw a $13.7 billion YoY increase from 2023 to 2024. Entertainment apps saw a $4.4 billion increase in spending from 2023 to 2024 in categories like photo and video, social networking, and productivity apps. There was a 44% YoY growth in the food and drink category, while shopping, finance, and travel apps saw a 20% increase in 2024. The report also mentioned that AI has become an important part of advertising strategies, content recommendations, and app discovery, and marketers are focusing on AI-driven personalization.

The mobile game market is very competitive, and after seeing some dips in growth in 2020 and 2021, mobile game developers have adjusted their strategies. There was less than a 5% decline in downloads in tier-one markets of mobile gaming like Japan, the US, South Korea, and Germany. Pakistan saw a 12% increase in downloads of mobile games between 2023 and 2024, while countries like Indonesia, Mexico, and the Philippines saw a 5% growth. Overall, there was a 1% decline in IAP (in-app purchase) revenue for mobile games, but casino games saw a 4% growth in IAP revenue, and mid-core games saw a 5% decline.

The report also surveyed consumers from different countries to compare the stats between 2023 and 2024. It was found that more than 50% of the respondents agreed that the industry is in good shape compared to 2023, while 80% said that it's the same or better in 2024. 85% of respondents from LATAM and North America agreed that the industry is better or the same right now. 86% of non-gaming marketers said that the industry is in better shape compared to 44% of gaming marketers who think that it is better in 2024 compared to 2023. 90% said that they have met or approached their KPIs, while more than 50% said that they are experiencing more aggressive KPIs year over year. 80% said that they have higher expectations for 2025, and 60% report expecting higher budgets in the new year.

Read next: The World’s Most (and Least) Cyber-Secure Countries: Where Does Yours Stand?

As app time increases, developers are also seeing an increase in revenue. The consumer spend on non-gaming apps was $3.5 billion in 2014, which increased to $69 billion in 2024, and saw a $13.7 billion YoY increase from 2023 to 2024. Entertainment apps saw a $4.4 billion increase in spending from 2023 to 2024 in categories like photo and video, social networking, and productivity apps. There was a 44% YoY growth in the food and drink category, while shopping, finance, and travel apps saw a 20% increase in 2024. The report also mentioned that AI has become an important part of advertising strategies, content recommendations, and app discovery, and marketers are focusing on AI-driven personalization.

The mobile game market is very competitive, and after seeing some dips in growth in 2020 and 2021, mobile game developers have adjusted their strategies. There was less than a 5% decline in downloads in tier-one markets of mobile gaming like Japan, the US, South Korea, and Germany. Pakistan saw a 12% increase in downloads of mobile games between 2023 and 2024, while countries like Indonesia, Mexico, and the Philippines saw a 5% growth. Overall, there was a 1% decline in IAP (in-app purchase) revenue for mobile games, but casino games saw a 4% growth in IAP revenue, and mid-core games saw a 5% decline.

The report also surveyed consumers from different countries to compare the stats between 2023 and 2024. It was found that more than 50% of the respondents agreed that the industry is in good shape compared to 2023, while 80% said that it's the same or better in 2024. 85% of respondents from LATAM and North America agreed that the industry is better or the same right now. 86% of non-gaming marketers said that the industry is in better shape compared to 44% of gaming marketers who think that it is better in 2024 compared to 2023. 90% said that they have met or approached their KPIs, while more than 50% said that they are experiencing more aggressive KPIs year over year. 80% said that they have higher expectations for 2025, and 60% report expecting higher budgets in the new year.

Read next: The World’s Most (and Least) Cyber-Secure Countries: Where Does Yours Stand?