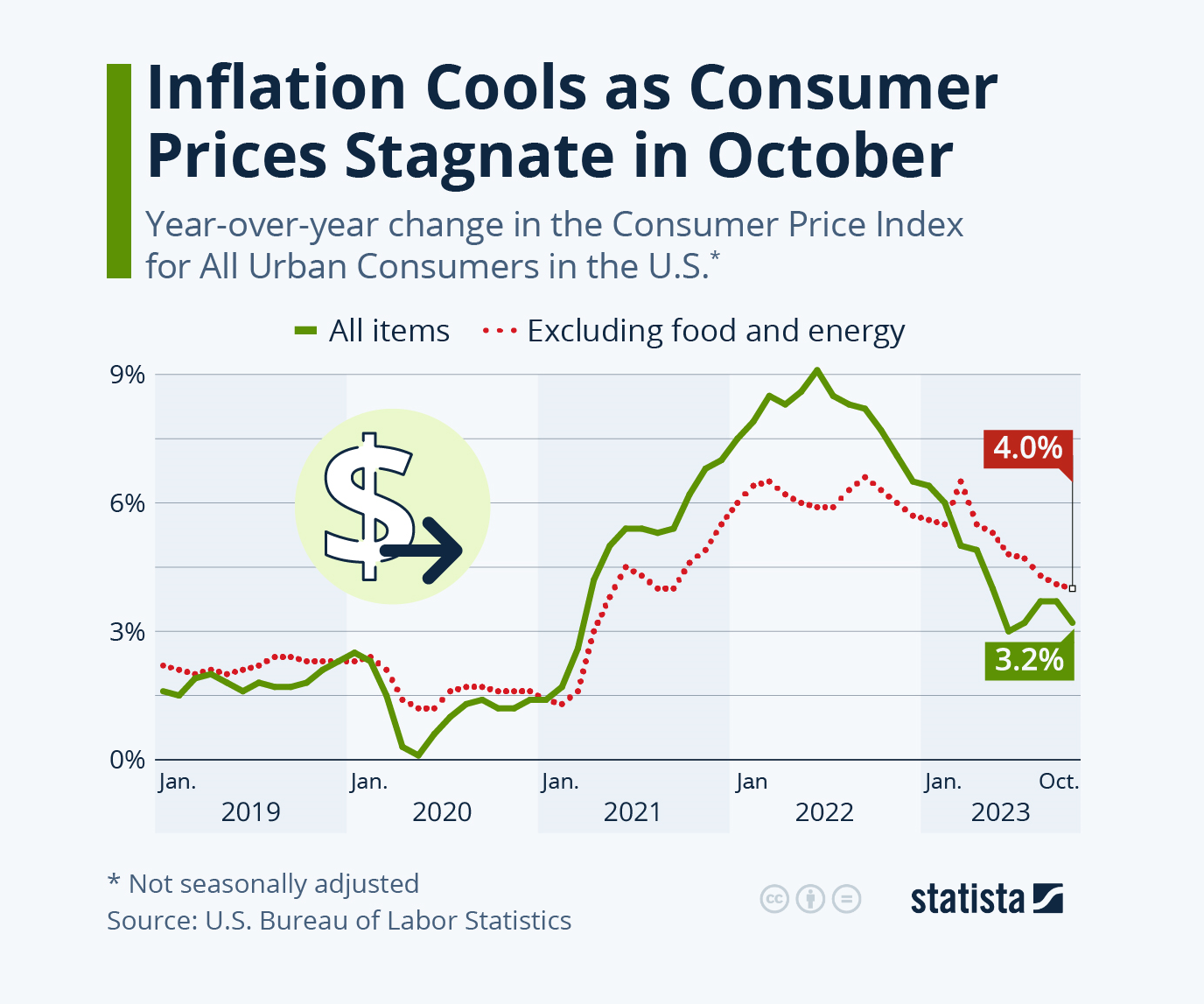

In October, the rate at which prices are rising in the U.S. (called inflation) slowed down more than people expected. This means that when you compare the prices of things from this October to last October, the increase isn't as big as it was in previous months. The government agency that keeps track of these price changes, the Bureau of Labor Statistics, said that prices went up by 3.2% over the last year. This is less than the 3.7% increase we saw in the months before and also lower than what experts thought would happen.

One interesting thing that happened in October is that prices didn’t change much from September. This is mainly because the cost of gas went down, which helped balance out the fact that rent and other costs for places to live went up. If we ignore food and energy (which can have big price changes quickly), the increase in prices was the smallest it's been since September 2021.

A big part of why prices are going up is because of the cost of housing, like rent. If we didn’t count housing costs, the increase in prices would be only 1.5%, which is actually below the 2% increase that the people who manage our economy, like the Federal Reserve (the Fed), think is okay.

Back in the spring of 2021, prices started to rise quickly, but at first, this was because they were so low during the start of the pandemic. However, by the end of 2021, the rising prices became a bigger problem. It got even worse when there was a conflict between Russia and Ukraine, which made food and energy prices go up a lot. Since that conflict has been going on for a while, it has made the prices stay high, and that's part of why we saw a big drop in inflation earlier this year.

The latest reports also show that fewer new jobs are being created, which is another sign of how the economy is doing. Together with the latest information on prices, it seems less likely that the Fed will increase interest rates in December. The Fed has kept interest rates steady since July, after they raised them a lot to try and control the fast rise in prices. This shows they are being careful about how they manage the economy right now.

Chart courtesy of: Statista

Read next: Fading Echoes of Connectivity - The Tale of Gaza's Struggle Against Digital Isolation

One interesting thing that happened in October is that prices didn’t change much from September. This is mainly because the cost of gas went down, which helped balance out the fact that rent and other costs for places to live went up. If we ignore food and energy (which can have big price changes quickly), the increase in prices was the smallest it's been since September 2021.

A big part of why prices are going up is because of the cost of housing, like rent. If we didn’t count housing costs, the increase in prices would be only 1.5%, which is actually below the 2% increase that the people who manage our economy, like the Federal Reserve (the Fed), think is okay.

Back in the spring of 2021, prices started to rise quickly, but at first, this was because they were so low during the start of the pandemic. However, by the end of 2021, the rising prices became a bigger problem. It got even worse when there was a conflict between Russia and Ukraine, which made food and energy prices go up a lot. Since that conflict has been going on for a while, it has made the prices stay high, and that's part of why we saw a big drop in inflation earlier this year.

The latest reports also show that fewer new jobs are being created, which is another sign of how the economy is doing. Together with the latest information on prices, it seems less likely that the Fed will increase interest rates in December. The Fed has kept interest rates steady since July, after they raised them a lot to try and control the fast rise in prices. This shows they are being careful about how they manage the economy right now.

Chart courtesy of: Statista

Read next: Fading Echoes of Connectivity - The Tale of Gaza's Struggle Against Digital Isolation