In an unexpected turn of events, the Twitter platform, now referred to as 'X' under Elon Musk's leadership, is grappling with a dire advertising crisis. A recent study by marketing consultancy Ebiquity reveals a troubling trend, as the majority of major advertisers have halted their advertising campaigns on 'X' since Musk's takeover.

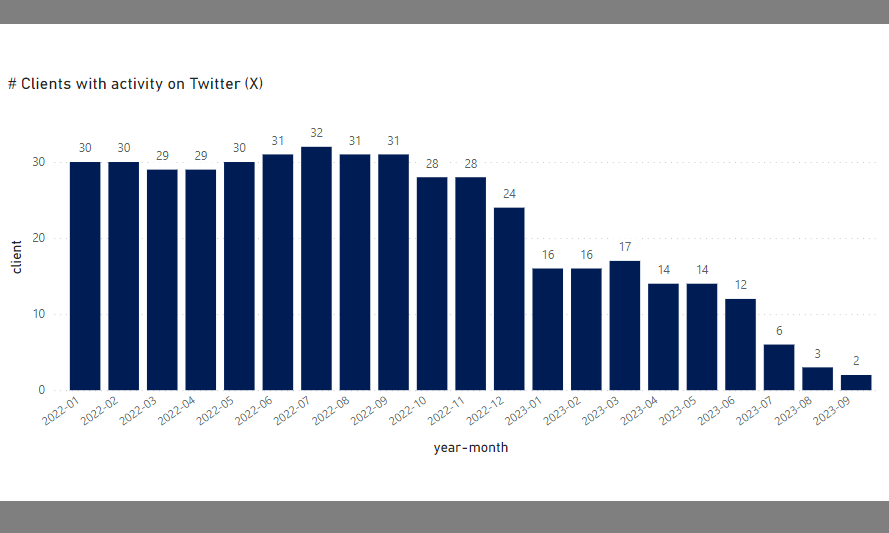

Contradicting the assurances of Musk and CEO Linda Yaccarino, the data from Ebiquity (via Insider) paints a concerning picture. In the last month, only two of Ebiquity's clients opted to run ads on 'X,' a significant drop from 31 brands in September 2022. This consultancy boasts partnerships with 70 of the top 100 highest-spending advertisers, including industry giants like Google, Walmart, and General Motors.

Image: Ebiquity via Insider

Ruben Schreurs, Chief Strategy Officer at Ebiquity, voiced his concerns, stating, "This is a drop we have not seen before for any major advertising platform." The numbers highlight 'X's financial challenges, as advertising historically constituted Twitter's primary source of revenue.

Musk and Yaccarino have presented audacious assertions concerning the resurgence of 'X.' At a recent Vox's Code Conference interview, Yaccarino claimed that within the "last 12 weeks," a whopping 90 percent of the top 100 advertisers had rejoined, accompanied by a pledge that the company would attain profitability in the upcoming year. Musk, echoing these sentiments back in April, declared that nearly the entirety of advertisers had either come back or signaled their intent to do so. However, the plot thickened in September when Musk openly admitted to a jaw-dropping 60 percent plunge in U.S. ad revenue, omitting the specific time frame for this financial nosedive.

The question arises: Is 'X' genuinely on the path to recovery, or is it still a financial abyss for Musk, who shouldered billions in debt to acquire the company? The credibility of 'X's leadership statements is now in doubt, as Schreurs raised substantial doubts about the reliability of 'growth claims' from both Musk and Yaccarino.

Musk's recent proposal to charge users $1 per year to combat spam and bot activity suggests a potential desperation for revenue. Whether this measure can prevent the platform from becoming an unmoderated haven for misinformation remains uncertain.

The platform's struggles may be attributed to its role in spreading misinformation, as verified users have been linked to viral false information. Additionally, a recent analysis by Similarweb indicates declining traffic and AppFigures highlights declining downloads and revenue, signaling that users are seeking alternatives amid the turmoil surrounding 'X.'

In conclusion, 'X,' under Musk's leadership, faces a challenging advertising landscape, and its future remains uncertain.

Read next: 6 Lessons to Learn from the Smartest CEOs in the World

Contradicting the assurances of Musk and CEO Linda Yaccarino, the data from Ebiquity (via Insider) paints a concerning picture. In the last month, only two of Ebiquity's clients opted to run ads on 'X,' a significant drop from 31 brands in September 2022. This consultancy boasts partnerships with 70 of the top 100 highest-spending advertisers, including industry giants like Google, Walmart, and General Motors.

Image: Ebiquity via Insider

Ruben Schreurs, Chief Strategy Officer at Ebiquity, voiced his concerns, stating, "This is a drop we have not seen before for any major advertising platform." The numbers highlight 'X's financial challenges, as advertising historically constituted Twitter's primary source of revenue.

Musk and Yaccarino have presented audacious assertions concerning the resurgence of 'X.' At a recent Vox's Code Conference interview, Yaccarino claimed that within the "last 12 weeks," a whopping 90 percent of the top 100 advertisers had rejoined, accompanied by a pledge that the company would attain profitability in the upcoming year. Musk, echoing these sentiments back in April, declared that nearly the entirety of advertisers had either come back or signaled their intent to do so. However, the plot thickened in September when Musk openly admitted to a jaw-dropping 60 percent plunge in U.S. ad revenue, omitting the specific time frame for this financial nosedive.

The question arises: Is 'X' genuinely on the path to recovery, or is it still a financial abyss for Musk, who shouldered billions in debt to acquire the company? The credibility of 'X's leadership statements is now in doubt, as Schreurs raised substantial doubts about the reliability of 'growth claims' from both Musk and Yaccarino.

Musk's recent proposal to charge users $1 per year to combat spam and bot activity suggests a potential desperation for revenue. Whether this measure can prevent the platform from becoming an unmoderated haven for misinformation remains uncertain.

The platform's struggles may be attributed to its role in spreading misinformation, as verified users have been linked to viral false information. Additionally, a recent analysis by Similarweb indicates declining traffic and AppFigures highlights declining downloads and revenue, signaling that users are seeking alternatives amid the turmoil surrounding 'X.'

In conclusion, 'X,' under Musk's leadership, faces a challenging advertising landscape, and its future remains uncertain.

Read next: 6 Lessons to Learn from the Smartest CEOs in the World