An interesting analysis was recently conducted and it shed light on how the majority of NFTs were worthless- a clear reminder to us all about how the NFT bubble has burst.

The study took into consideration a whopping 73,257 collections and out of those, 95% were said to be of zero value in today’s day and age.

For those who may not be aware, the market and trend for Non-Fungible Tokens really came down to crashing as per a new report from experts at dappGambl.

Thanks to data outlined by the reliable NFT Scan, it was proven that out of the figure outlined above, a whopping 69,795 entailed a market cap featuring 0 Ether.

This particular report highlighted how 95% of those interested in collecting such tokens must be aware of their zero worth so there is no point in this.

Out of the respective tokens that are rumored to be worth a small figure, 41% of those cost as low as $5 and as high as $100. And you’ll be amazed to learn how 1% and even less than that figure had sales at a price tag of $6000. So in case you were searching for that million-dollar era where the NFT was once booming, that’s very much over.

This report highlights something very important and that is linked to how unpredictable and risky this entire NFT market has turned into in today’s day and age. Moreover, it also proves to us how there is a much stronger need to be careful and practice diligence, right before you take the leap and make a huge buy especially one of greater value.

As experts mentioned, the daunting reality that we’re highlighting is a huge reality check for the world about the euphoria linked to NFTs and how the space is far from what many had once predicted or perceived it to be.

It’s actually really disappointing when you come to think of it. Who knew that such stories about digital art being sold for millions and many getting rich overnight would ultimately end with this final outcome?

Yes, today’s market continues to shift as we speak. Trends are never stagnant but the pitfalls and losses seen here are worth a mention.

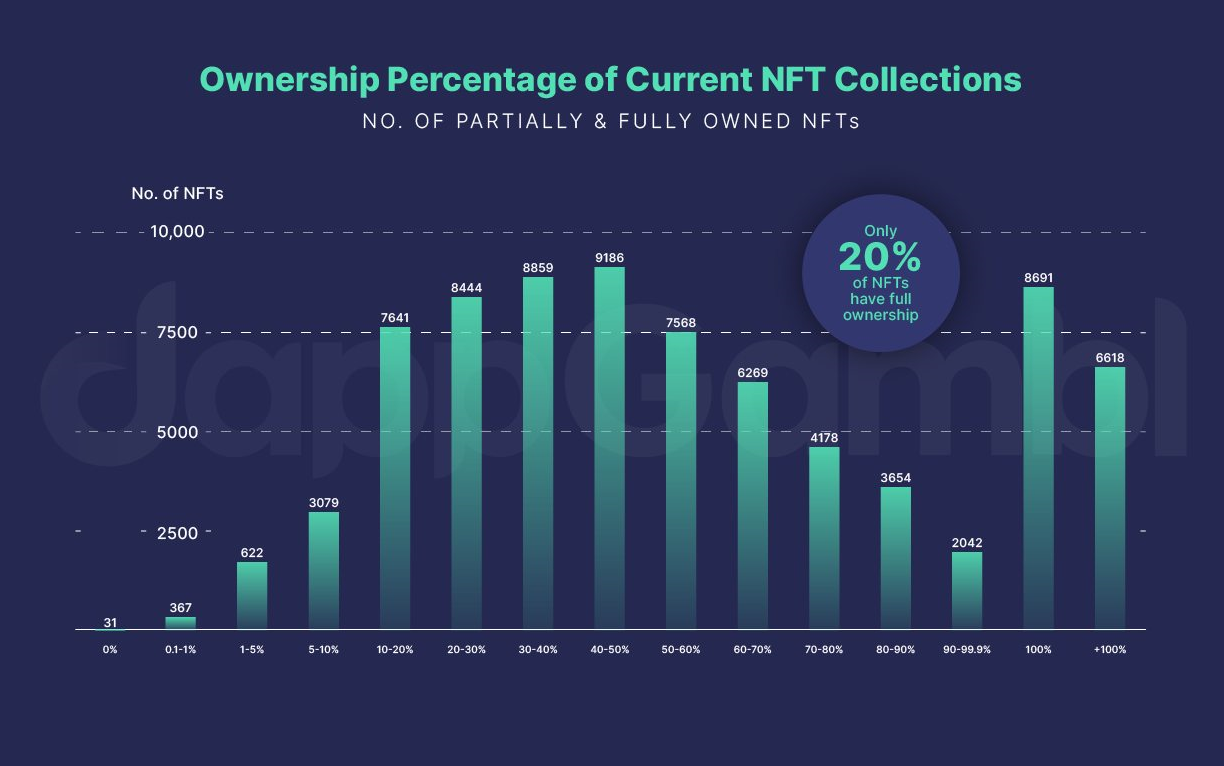

Today, researchers feel that one out of five NFT collections are under the ownership of someone else. Moreover, they reflect the real demand for such assets in today’s ever-changing landscape.

Furthermore, when you consider the changes arising nearly two years back, it’s huge. At that period of time, we saw the NFT market at its peak and the trading volume happened to be close to $2.8 billion.

Therefore, both artists, as well as other big names from the industry, saw users jump on the bandwagon linked to the latest tech trends where people were super eager in terms of capitalizing and making the most of this opportunity.

One firm started to launch frames and NFT enthusiasts really worked hard in terms of selling digital art that was unique and truly one of a kind.

Today, the figures prove to us how the entire block show comprising of traded values fluctuates on a daily basis. It’s at $80 million today, close to 3% of the height it attained two years back.

Whatever the case may and no matter how grim these facts and figures are in this new analysis, there was a conclusion made that perhaps a future does still exist for the world of NFTs. But we’re very skeptical about this front. What are your thoughts?

Read next: Metaverse Searches Decrease by 71 Percent In a Year

The study took into consideration a whopping 73,257 collections and out of those, 95% were said to be of zero value in today’s day and age.

For those who may not be aware, the market and trend for Non-Fungible Tokens really came down to crashing as per a new report from experts at dappGambl.

Thanks to data outlined by the reliable NFT Scan, it was proven that out of the figure outlined above, a whopping 69,795 entailed a market cap featuring 0 Ether.

This particular report highlighted how 95% of those interested in collecting such tokens must be aware of their zero worth so there is no point in this.

Out of the respective tokens that are rumored to be worth a small figure, 41% of those cost as low as $5 and as high as $100. And you’ll be amazed to learn how 1% and even less than that figure had sales at a price tag of $6000. So in case you were searching for that million-dollar era where the NFT was once booming, that’s very much over.

This report highlights something very important and that is linked to how unpredictable and risky this entire NFT market has turned into in today’s day and age. Moreover, it also proves to us how there is a much stronger need to be careful and practice diligence, right before you take the leap and make a huge buy especially one of greater value.

As experts mentioned, the daunting reality that we’re highlighting is a huge reality check for the world about the euphoria linked to NFTs and how the space is far from what many had once predicted or perceived it to be.

It’s actually really disappointing when you come to think of it. Who knew that such stories about digital art being sold for millions and many getting rich overnight would ultimately end with this final outcome?

Yes, today’s market continues to shift as we speak. Trends are never stagnant but the pitfalls and losses seen here are worth a mention.

Today, researchers feel that one out of five NFT collections are under the ownership of someone else. Moreover, they reflect the real demand for such assets in today’s ever-changing landscape.

Furthermore, when you consider the changes arising nearly two years back, it’s huge. At that period of time, we saw the NFT market at its peak and the trading volume happened to be close to $2.8 billion.

Therefore, both artists, as well as other big names from the industry, saw users jump on the bandwagon linked to the latest tech trends where people were super eager in terms of capitalizing and making the most of this opportunity.

One firm started to launch frames and NFT enthusiasts really worked hard in terms of selling digital art that was unique and truly one of a kind.

Today, the figures prove to us how the entire block show comprising of traded values fluctuates on a daily basis. It’s at $80 million today, close to 3% of the height it attained two years back.

Whatever the case may and no matter how grim these facts and figures are in this new analysis, there was a conclusion made that perhaps a future does still exist for the world of NFTs. But we’re very skeptical about this front. What are your thoughts?

Read next: Metaverse Searches Decrease by 71 Percent In a Year