The allure of monetizing apps through subscriptions has become a well-established strategy for developers seeking financial gains. On the other hand, the topic of how standard subscription-based income models are in applications and games remains fascinating. This information's disclosure throws insight into the extent to which subscriptions have infiltrated the App Store marketplace.

The scope of subscription-based monetization inside the iOS ecosystem was examined using Explorer, a market research tool. While the present research is limited to the App Store due to the lack of a comparable filter for Google Play, it comprehensively summarizes subscription patterns in the iOS sector.

Currently, a whopping 232,000 applications and games on the App Store have at least one recurring in-app purchase, which functions as a subscription. According to this figure, 15% of all applications and games available on the App Store use subscription-based income models. This demonstrates the widespread use of this monetization strategy, highlighting its success in producing income.

An intriguing issue arises: how many of these subscription-based apps are paid? Contrary to popular belief, the solution indicates a larger number. The frequency of premium applications with subscription models is greater than expected. This dynamic introduces a fascinating new dimension to the monetization environment that begs more investigation.

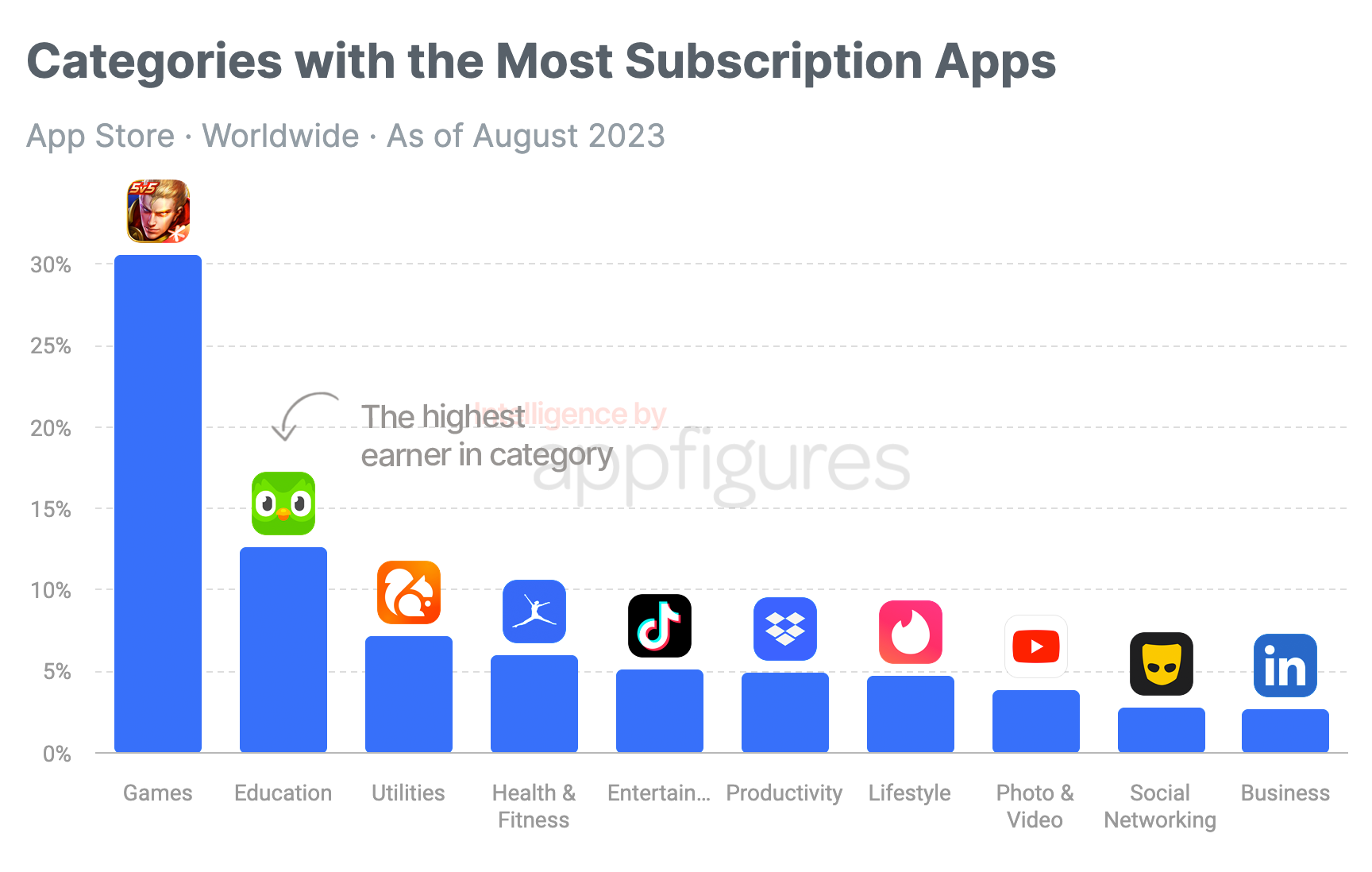

Delving deeper into the analysis, the revelation that the games category claims the lion's share of subscription apps is noteworthy. Surpassing expectations, games account for a significant 31% of all subscription apps in the App Store. Games' prominence in this space may be ascribed to their intrinsic engagement and the consequent income streams that subscription models can generate. With several top-grossing games integrating subscriptions, the games sector has emerged as a suitable location for this business model.

Reflecting on this trajectory, it is clear that a significant shift occurred once the games industry discovered the possibilities of subscriptions. The rising use of subscription models in games signaled the beginning of a transformational moment, driving gaming to the forefront of the subscription landscape. Notably, nearly 1,500 plays in this category have earned over $100,000 in net income in the last month, demonstrating the financial sustainability of subscriptions.

Beyond the games category, the education sector emerges as the second-largest category, with a 13% subscription prevalence, followed by utilities at 7%. Health & Fitness, Entertainment, Productivity, Lifestyle, Photo & Video, and Social Networking contribute with single-digit subscription representations.

Surprisingly, the business sector, which is frequently thought to be the leader in subscription uptake, ranks 10th with only a 3% presence. This surprising posture is explained by the fact that many business apps operate as clients for web platforms that primarily handle subscription models.

When looking ahead, the subject of subscription-based app growth becomes critical. Predictions for the coming year spark curiosity in a year defined by an infusion of 3,000 to 4,000 new iOS applications (and games) every month, encouraging thought about probable shifts and expansions in this environment.

Finally, an unusual discovery emerges—7,500 applications are a combination of paid apps and subscription offers. This category is again led by games, education, and utilities.

These insights come from the App Intelligence platform, which provides revenue and download estimates as well as information on installed SDKs. These statistics demonstrate the breadth of information available to developers, influencing strategic decisions and providing helpful insight into industry trends.

As the iOS app ecosystem evolves, investigating subscription-based revenue models provides a comprehensive picture of the dynamic interplay between monetization tactics and user preferences. This research is a useful benchmark, indicating potential areas for future app development and giving a road map for navigating the complex world of app monetization.

H/T: AppFigures

Read next: This Freelance Writing Job Lets You Earn $250 an Hour Remotely Without a Degree

The scope of subscription-based monetization inside the iOS ecosystem was examined using Explorer, a market research tool. While the present research is limited to the App Store due to the lack of a comparable filter for Google Play, it comprehensively summarizes subscription patterns in the iOS sector.

Currently, a whopping 232,000 applications and games on the App Store have at least one recurring in-app purchase, which functions as a subscription. According to this figure, 15% of all applications and games available on the App Store use subscription-based income models. This demonstrates the widespread use of this monetization strategy, highlighting its success in producing income.

An intriguing issue arises: how many of these subscription-based apps are paid? Contrary to popular belief, the solution indicates a larger number. The frequency of premium applications with subscription models is greater than expected. This dynamic introduces a fascinating new dimension to the monetization environment that begs more investigation.

Delving deeper into the analysis, the revelation that the games category claims the lion's share of subscription apps is noteworthy. Surpassing expectations, games account for a significant 31% of all subscription apps in the App Store. Games' prominence in this space may be ascribed to their intrinsic engagement and the consequent income streams that subscription models can generate. With several top-grossing games integrating subscriptions, the games sector has emerged as a suitable location for this business model.

Reflecting on this trajectory, it is clear that a significant shift occurred once the games industry discovered the possibilities of subscriptions. The rising use of subscription models in games signaled the beginning of a transformational moment, driving gaming to the forefront of the subscription landscape. Notably, nearly 1,500 plays in this category have earned over $100,000 in net income in the last month, demonstrating the financial sustainability of subscriptions.

Beyond the games category, the education sector emerges as the second-largest category, with a 13% subscription prevalence, followed by utilities at 7%. Health & Fitness, Entertainment, Productivity, Lifestyle, Photo & Video, and Social Networking contribute with single-digit subscription representations.

Surprisingly, the business sector, which is frequently thought to be the leader in subscription uptake, ranks 10th with only a 3% presence. This surprising posture is explained by the fact that many business apps operate as clients for web platforms that primarily handle subscription models.

When looking ahead, the subject of subscription-based app growth becomes critical. Predictions for the coming year spark curiosity in a year defined by an infusion of 3,000 to 4,000 new iOS applications (and games) every month, encouraging thought about probable shifts and expansions in this environment.

Finally, an unusual discovery emerges—7,500 applications are a combination of paid apps and subscription offers. This category is again led by games, education, and utilities.

These insights come from the App Intelligence platform, which provides revenue and download estimates as well as information on installed SDKs. These statistics demonstrate the breadth of information available to developers, influencing strategic decisions and providing helpful insight into industry trends.

As the iOS app ecosystem evolves, investigating subscription-based revenue models provides a comprehensive picture of the dynamic interplay between monetization tactics and user preferences. This research is a useful benchmark, indicating potential areas for future app development and giving a road map for navigating the complex world of app monetization.

H/T: AppFigures

Read next: This Freelance Writing Job Lets You Earn $250 an Hour Remotely Without a Degree