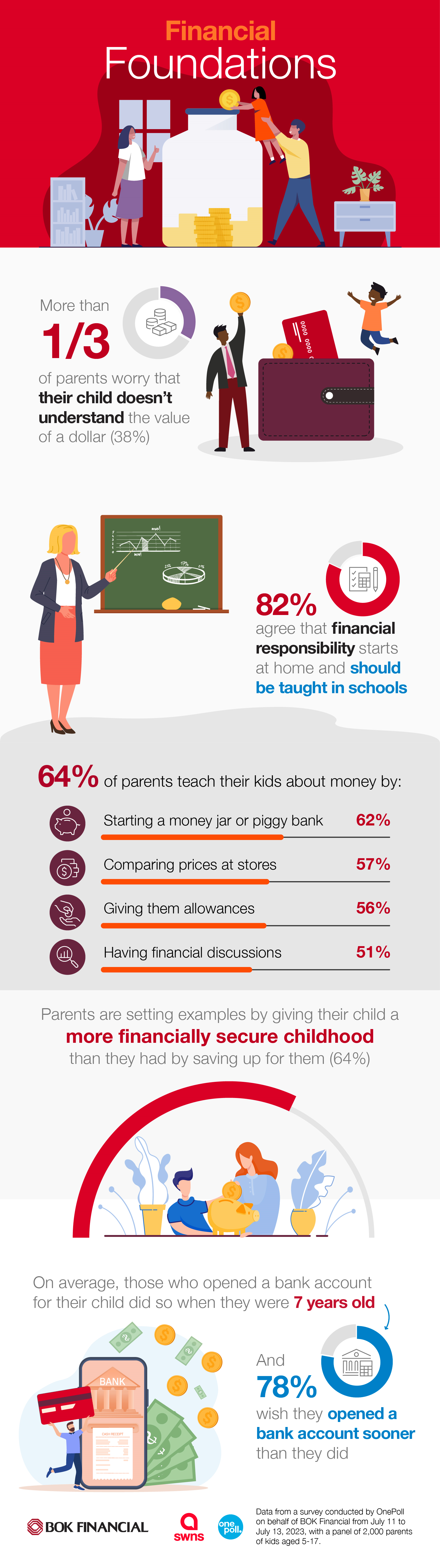

Over a third of parents, 38% to be exact, are concerned about their children having no knowledge or understanding of the importance of the dollar in the financial economy.

The results of a OnePoll survey for BOK Financial, conducted on 2000 parents with children between the ages of 5 and 17, stressed the importance of educating their children about finances at a young age. 82% of the respondents concurred that financial accountability begins at home.

The parents claimed that most responsibility regarding money starts at age 15. Therefore, 85% of the respondents believe that parents must educate their kids on the worth of the dollar currency, along with ways of managing their money. They believe it is essential to do so when their children are young so that they do not struggle with their finances once they become teens and later enter adulthood.

Additionally, 82% of the respondents believe that schools should step in and educate their children about financial skills and managing their money.

However, results also showed that about 29% of the respondents believe that their children are not taught about financial education in school enough.

To tackle this lack of financial knowledge, 62% of the parents decided to educate their children on ways to save money by introducing them to the concept of a piggy bank or a money jar. They gave their children allowances to teach them about budgeting.

More than half of the respondents, 57% of them, taught their kids how to manage their money by shopping, making them weigh up the differences in prices of various products or about 51% of them sat down with their children to help them understand finances better.

The survey results also revealed that, on average, the respondent believes that an individual must have proper and complete financial knowledge once they become 22 years old.

Consumer product strategy manager from BOK, Leasa Melton, believed that parents would leave everything up to luck if they weren't deliberate about giving their children financial knowledge. Knowing that financial stability is crucial in aiding an individual’s overall well-being in the long run, such steps taken by parents could be lasting and highly impactful. She further elaborated that teaching kids ways to simply budget can encourage problem-solving and thinking skills and develop their discipline.

84% of the respondents revealed that teenage high school students earning is a crucial part of their learning journey when it comes to being responsible about their finances.

More than half of the respondents, 51% of them, revealed to have children who were already working and earning money by exploring gigs such as selling their baked goods or lemonade stalls (63%) or selling handcrafted products. 57% of the respondents claimed that their children earned money through their weekly allowance. 42% of the respondents claimed that their children earned through their social media accounts.

Parents believe that setting up such a positive example regarding finances can be influential in helping their children become better with their money-spending habits as often, they grow up to have similar financial habits as their parents. 64% of the parents have made it essential that their kids have more financial stability than they did when they were their age by saving some money for them.

On average, parents have around $14,000 saved in their children’s names. 56% of the respondents already have a bank account made for their kid, but 28% do not and claim that they may regret it later in life. 79% of parents with no bank accounts for their kids claimed to wish they had one opened sooner.

Melton further encouraged parents that the sooner they educate their children about finances and open up their bank accounts, the better it will be for both the parent and the child. Teaching them how to save, spend, and budget very early on in life, answering their questions on how to spend money, and letting them practice those financial skills is crucial to help them grow financially stable.

Read next: The FTC Has Received Over 500,000 Credit Bureau Fraud Claims in H1 2023 Alone

The results of a OnePoll survey for BOK Financial, conducted on 2000 parents with children between the ages of 5 and 17, stressed the importance of educating their children about finances at a young age. 82% of the respondents concurred that financial accountability begins at home.

The parents claimed that most responsibility regarding money starts at age 15. Therefore, 85% of the respondents believe that parents must educate their kids on the worth of the dollar currency, along with ways of managing their money. They believe it is essential to do so when their children are young so that they do not struggle with their finances once they become teens and later enter adulthood.

Additionally, 82% of the respondents believe that schools should step in and educate their children about financial skills and managing their money.

However, results also showed that about 29% of the respondents believe that their children are not taught about financial education in school enough.

To tackle this lack of financial knowledge, 62% of the parents decided to educate their children on ways to save money by introducing them to the concept of a piggy bank or a money jar. They gave their children allowances to teach them about budgeting.

More than half of the respondents, 57% of them, taught their kids how to manage their money by shopping, making them weigh up the differences in prices of various products or about 51% of them sat down with their children to help them understand finances better.

The survey results also revealed that, on average, the respondent believes that an individual must have proper and complete financial knowledge once they become 22 years old.

Consumer product strategy manager from BOK, Leasa Melton, believed that parents would leave everything up to luck if they weren't deliberate about giving their children financial knowledge. Knowing that financial stability is crucial in aiding an individual’s overall well-being in the long run, such steps taken by parents could be lasting and highly impactful. She further elaborated that teaching kids ways to simply budget can encourage problem-solving and thinking skills and develop their discipline.

84% of the respondents revealed that teenage high school students earning is a crucial part of their learning journey when it comes to being responsible about their finances.

More than half of the respondents, 51% of them, revealed to have children who were already working and earning money by exploring gigs such as selling their baked goods or lemonade stalls (63%) or selling handcrafted products. 57% of the respondents claimed that their children earned money through their weekly allowance. 42% of the respondents claimed that their children earned through their social media accounts.

Parents believe that setting up such a positive example regarding finances can be influential in helping their children become better with their money-spending habits as often, they grow up to have similar financial habits as their parents. 64% of the parents have made it essential that their kids have more financial stability than they did when they were their age by saving some money for them.

On average, parents have around $14,000 saved in their children’s names. 56% of the respondents already have a bank account made for their kid, but 28% do not and claim that they may regret it later in life. 79% of parents with no bank accounts for their kids claimed to wish they had one opened sooner.

Melton further encouraged parents that the sooner they educate their children about finances and open up their bank accounts, the better it will be for both the parent and the child. Teaching them how to save, spend, and budget very early on in life, answering their questions on how to spend money, and letting them practice those financial skills is crucial to help them grow financially stable.

Read next: The FTC Has Received Over 500,000 Credit Bureau Fraud Claims in H1 2023 Alone