According to the latest report released by digital marketing agency Pathmatics, the overall ad spend in the United States alone has gone up by 5% in the third quarter of the ongoing year.

Despite brands going through an economic crisis, it appears that the digital ad spending sector is doing pretty well, as ad spending had crossed $23 billion at the end of September 2022.

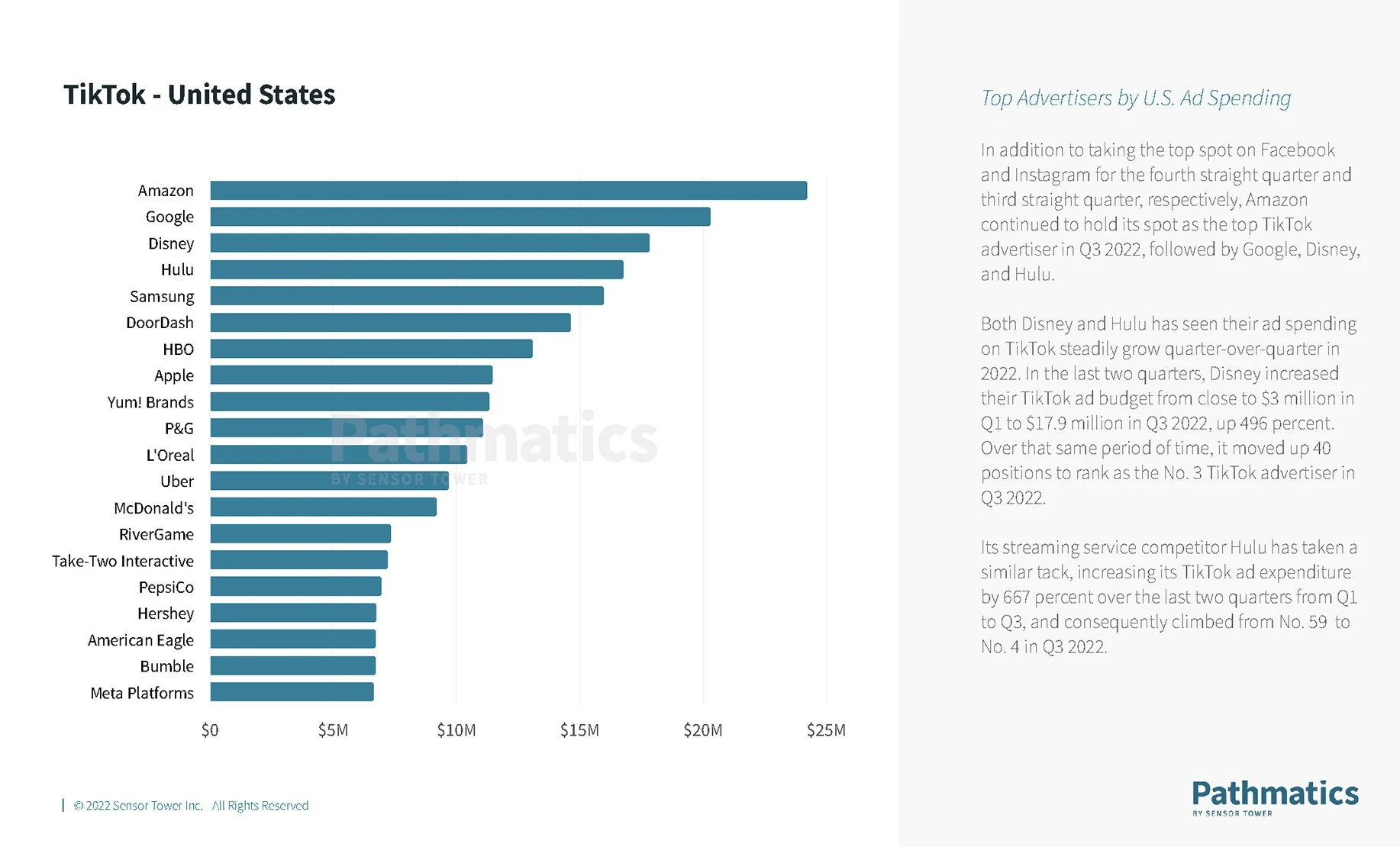

With Meta-owned Facebook leading the advertising trend chart, ByteDance’s TikTok was successfully able to have the highest growth rate. The short video platform experienced a 29% rise in its ad spending while the famous e-commerce platform, Amazon, became the number 1 advertiser brand for TikTok. Amazon was just ahead of tech giant Google, with Disney coming in at the third spot.

With Disney going head-to-head with Hulu, Hulu increased its advertising budget by 667% during the previous 2 quarters. To reach a larger audience, online streaming applications preferred social media platforms for their ad campaigns. The famous HBO Max went forward with Meta’s Facebook while the most common Netflix decided to use TikTok for its campaign, as shown by the data received from April to September. This shift indicates that social platforms are now considered more potent for running ad campaigns for different brands.

Not only this, but the report also covered several areas, which included the names of top advertisers and the amount of money they have spent so far. Different categories were also part of the complete analytical report.

To assist new advertisers or guide struggling ones, the Pathmatic report included creative ideas used by big brands and agencies, along with how much such brands spend on advertisements from one quarter to the next.

Lastly, it was also made a part of this report to discuss what influence the current economic situation has on different brands and agencies and how the big names are taking initiatives or planning ideas to protect themselves from being caught in this situation.

With the last quarter almost about to reach its end, the data report will further clarify whether things are going well or slipping out of hand.

Read next: AR/VR Shopping in the US: The Next Big Thing or A Big Flop?

Despite brands going through an economic crisis, it appears that the digital ad spending sector is doing pretty well, as ad spending had crossed $23 billion at the end of September 2022.

With Meta-owned Facebook leading the advertising trend chart, ByteDance’s TikTok was successfully able to have the highest growth rate. The short video platform experienced a 29% rise in its ad spending while the famous e-commerce platform, Amazon, became the number 1 advertiser brand for TikTok. Amazon was just ahead of tech giant Google, with Disney coming in at the third spot.

With Disney going head-to-head with Hulu, Hulu increased its advertising budget by 667% during the previous 2 quarters. To reach a larger audience, online streaming applications preferred social media platforms for their ad campaigns. The famous HBO Max went forward with Meta’s Facebook while the most common Netflix decided to use TikTok for its campaign, as shown by the data received from April to September. This shift indicates that social platforms are now considered more potent for running ad campaigns for different brands.

Not only this, but the report also covered several areas, which included the names of top advertisers and the amount of money they have spent so far. Different categories were also part of the complete analytical report.

To assist new advertisers or guide struggling ones, the Pathmatic report included creative ideas used by big brands and agencies, along with how much such brands spend on advertisements from one quarter to the next.

Lastly, it was also made a part of this report to discuss what influence the current economic situation has on different brands and agencies and how the big names are taking initiatives or planning ideas to protect themselves from being caught in this situation.

With the last quarter almost about to reach its end, the data report will further clarify whether things are going well or slipping out of hand.

Read next: AR/VR Shopping in the US: The Next Big Thing or A Big Flop?