Many regular consumers who saw the meteoric rise of Bitcoin in the previous few years felt a sense of FOMO, especially when they saw people who made small investments becoming millionaires overnight. This led to a flood of new crypto tokens as well as the notorious NFT craze of last year, but in spite of the fact that this is the case many of these supposed investment opportunities turned out to be unsustainable at best and outright fraudulent at worst.

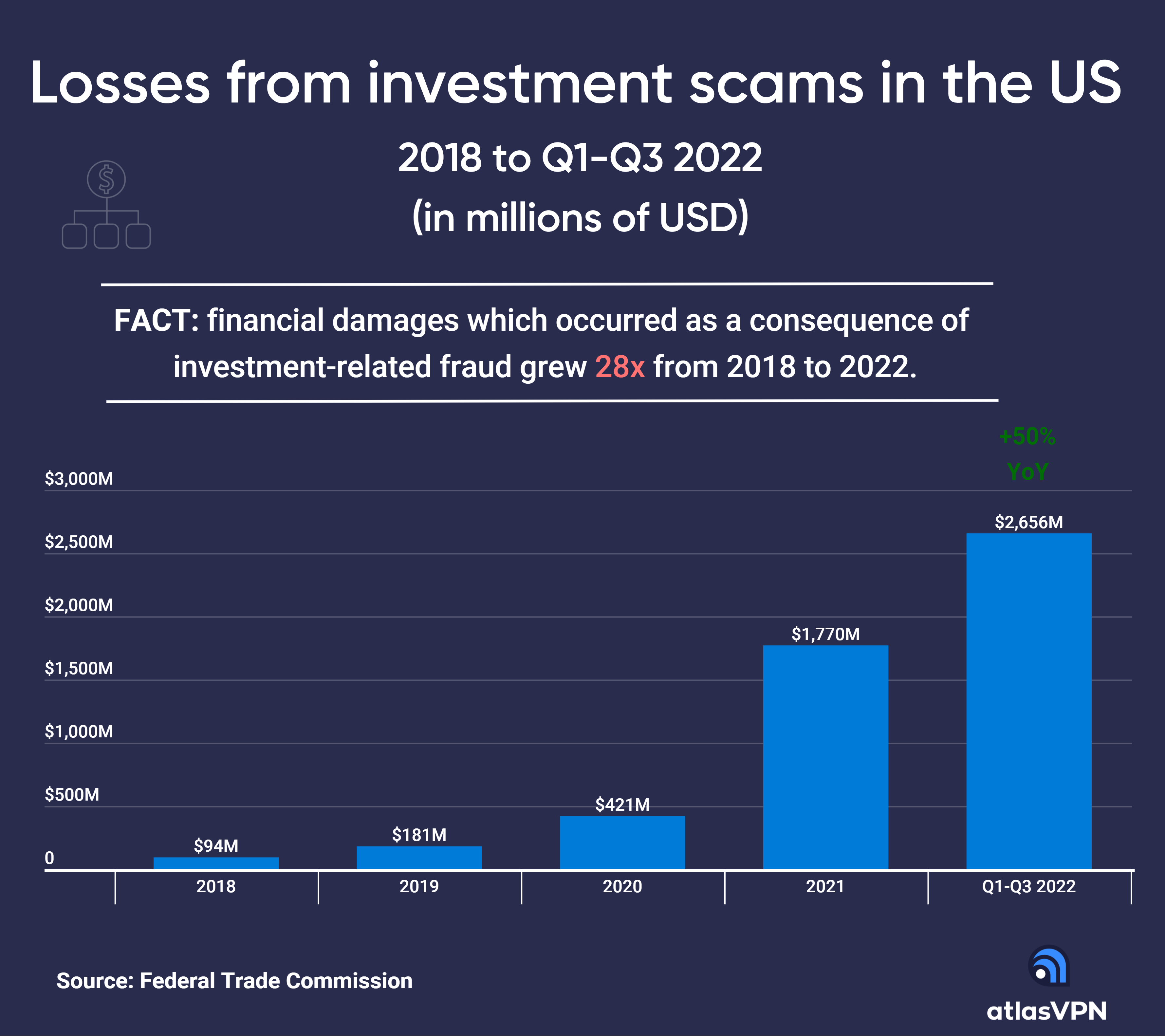

With all of that having been said and now out of the way, it is important to note that losses related to investment scams have increased by 50% year over year. American citizens lost almost $2.7 billion to these scams just this year, or $2.66 billion to be precise. This type of fraud has been increasing by 148% on average per year, and it is making it harder for Americans to invest than might have been the case otherwise.

The Federal Trade Commission has received over 80,000 complaints in the first three quarters of 20220, and considering that the year is still not over this number could end up being even higher with all things having been considered and taken into account. 74% of the complaints stated that the complainant suffered a financial loss, and the FTC must be quick to act because of the fact that this is the sort of thing that could potentially end up preventing others from falling down the crypto rabbit hole.

The very nature of crypto currency might make it prone to all sorts of scams. There are a lot of anonymity oriented crypto tokens that are hard to track, but the promise of untold wealth can be too great for anyone to consider passing up. Median losses are also on the rise, with average losses now totalling $4500 per individual which is a 50% increase from the $3,000 average losses that were seen a year prior. These scams and frauds are becoming ever more prevalent and investors must be cautious about what they decide to put their money into.

H/T: Atlasvpn

Read next: Average Cost Per Lead of Google Ads has gone up from 5 percent to 19 percent in one year

With all of that having been said and now out of the way, it is important to note that losses related to investment scams have increased by 50% year over year. American citizens lost almost $2.7 billion to these scams just this year, or $2.66 billion to be precise. This type of fraud has been increasing by 148% on average per year, and it is making it harder for Americans to invest than might have been the case otherwise.

The Federal Trade Commission has received over 80,000 complaints in the first three quarters of 20220, and considering that the year is still not over this number could end up being even higher with all things having been considered and taken into account. 74% of the complaints stated that the complainant suffered a financial loss, and the FTC must be quick to act because of the fact that this is the sort of thing that could potentially end up preventing others from falling down the crypto rabbit hole.

The very nature of crypto currency might make it prone to all sorts of scams. There are a lot of anonymity oriented crypto tokens that are hard to track, but the promise of untold wealth can be too great for anyone to consider passing up. Median losses are also on the rise, with average losses now totalling $4500 per individual which is a 50% increase from the $3,000 average losses that were seen a year prior. These scams and frauds are becoming ever more prevalent and investors must be cautious about what they decide to put their money into.

H/T: Atlasvpn

Read next: Average Cost Per Lead of Google Ads has gone up from 5 percent to 19 percent in one year