Inflation is a problem that has recently been at an all-time high around the world especially in the developing countries. In the United Kingdom Inflation reached a stupendous amount in the last 30 years creating problems for the middle and poor classes, leading to many being homeless.

The figures of the income and the international prices were very weak and strong respectively. Keeping that in mind in early May the State Bank of England has issued a statement saying that inflation is expected to rise up 10.2% this year only and will rise up in the future as well.

As stated above the rest of the world is also facing pretty much the same circumstances. In the USA inflation has reached its highest in 40 years with the prices of Fuel, Food and Housing rising with an unnatural speed. The developing countries are facing inflation of the highest kind as they were already poor with inflation not doing much for them. As an example inflation in Pakistan was 9.2% in just this past year and in this one it has reached a whopping 13.8% in May.

In the UK however, Inflation has not made its mark yet as two thirds of consumers say that while they recognize the effect and the dangers of inflation, it has achieved little to a huge effect on their daily lives. Only 6% of consumers say that Inflation has made no effect on their lives.

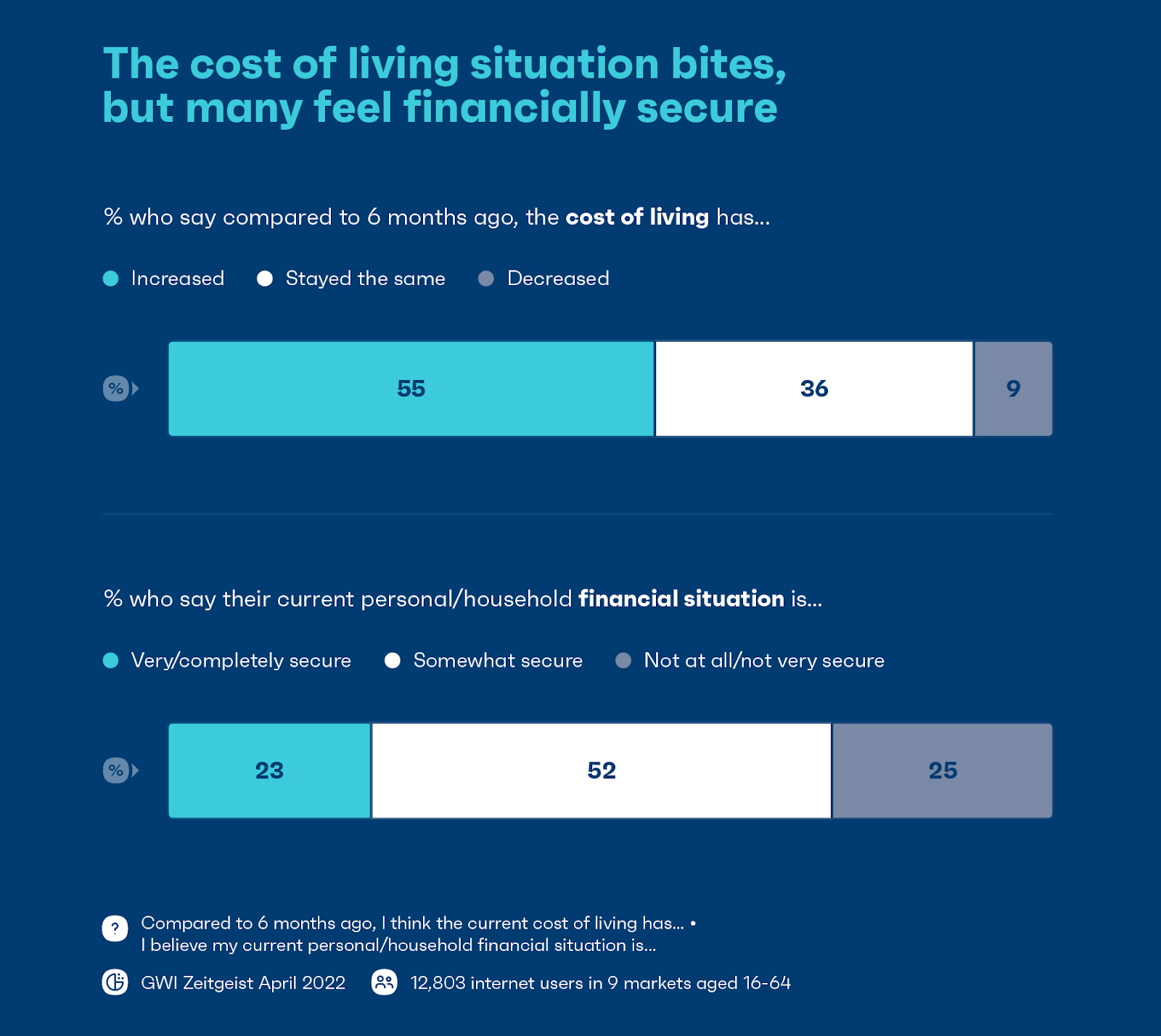

According to a survey conducted by GWI, 55% of people said that in the light of current inflation the prices have increased while 9% said that it has stayed the same. The opinion of only 9% of people was that with the current inflation prices have actually decreased. In the response to another question about if they believed that their finances were stable or not more than half (52%) said that they were somewhat secure. 23% believe that their finances are completely secure while the remaining 25% think that they are not secure at all.

The same survey also revealed that baby boomers are more likely to say that the prices of housing have increased if put in comparison with the younger generation. We saw this when 49% of millennials said this as compared to the 77% of baby boomers.

However this financial security varies from country to county, for example in France and Italy 2 out of 5 people said that they are not financially secure.

Even though many people have not felt the effect of price hikes, nobody is immune to them and some people have felt the effects much more than others. These people are likely to be the older generation and/or the low income groups.

The older generation is generally more price conscious and more wanting of a financial safety net beneath them. Just because they are the price conscious one it does not mean that they are immune to inflation.

According to governmental figures households were already under strain to warm one’s home or to fill their car’s tank even before the recent increases in prices.

Read next: Are You Looking For The Top 100 Places To Find The Best Jobs In 2022, Here are some for you!

The figures of the income and the international prices were very weak and strong respectively. Keeping that in mind in early May the State Bank of England has issued a statement saying that inflation is expected to rise up 10.2% this year only and will rise up in the future as well.

As stated above the rest of the world is also facing pretty much the same circumstances. In the USA inflation has reached its highest in 40 years with the prices of Fuel, Food and Housing rising with an unnatural speed. The developing countries are facing inflation of the highest kind as they were already poor with inflation not doing much for them. As an example inflation in Pakistan was 9.2% in just this past year and in this one it has reached a whopping 13.8% in May.

In the UK however, Inflation has not made its mark yet as two thirds of consumers say that while they recognize the effect and the dangers of inflation, it has achieved little to a huge effect on their daily lives. Only 6% of consumers say that Inflation has made no effect on their lives.

According to a survey conducted by GWI, 55% of people said that in the light of current inflation the prices have increased while 9% said that it has stayed the same. The opinion of only 9% of people was that with the current inflation prices have actually decreased. In the response to another question about if they believed that their finances were stable or not more than half (52%) said that they were somewhat secure. 23% believe that their finances are completely secure while the remaining 25% think that they are not secure at all.

The same survey also revealed that baby boomers are more likely to say that the prices of housing have increased if put in comparison with the younger generation. We saw this when 49% of millennials said this as compared to the 77% of baby boomers.

However this financial security varies from country to county, for example in France and Italy 2 out of 5 people said that they are not financially secure.

Even though many people have not felt the effect of price hikes, nobody is immune to them and some people have felt the effects much more than others. These people are likely to be the older generation and/or the low income groups.

The older generation is generally more price conscious and more wanting of a financial safety net beneath them. Just because they are the price conscious one it does not mean that they are immune to inflation.

According to governmental figures households were already under strain to warm one’s home or to fill their car’s tank even before the recent increases in prices.

Read next: Are You Looking For The Top 100 Places To Find The Best Jobs In 2022, Here are some for you!