The cost of obtaining a new iOS user has dropped by 13%, whereas that of a new Android user has surged by 35%.

Statistics competence is well-known among gaming application developers. Last month, The State of Gaming App Marketing for 2022, was published by AppsFlyer. It is detailed research on important game trends that will support advertisers with developing new techniques & eventually mastering the fresh period of cybersecurity.

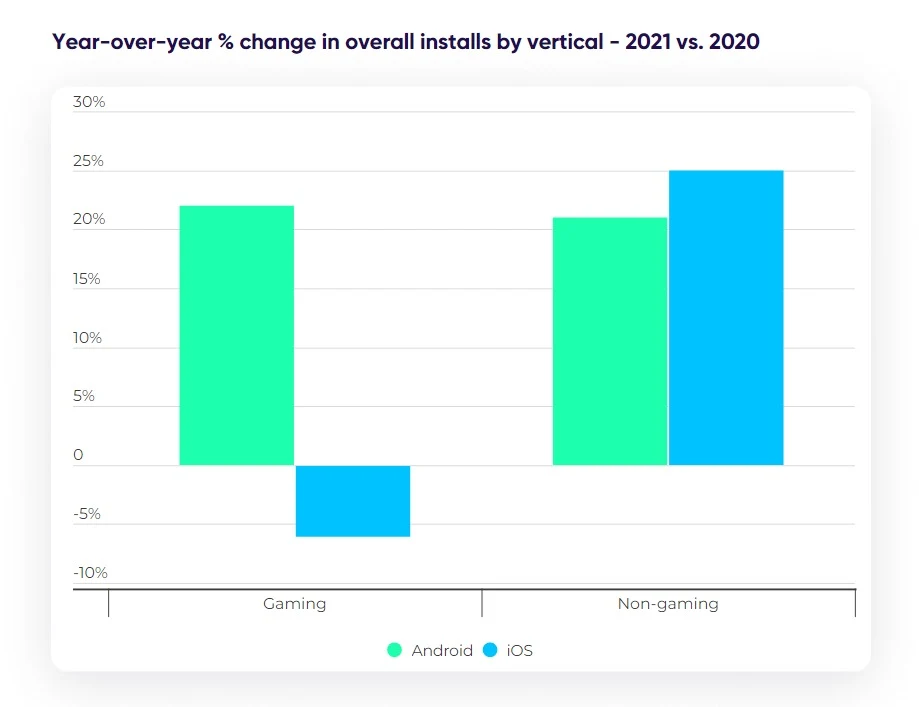

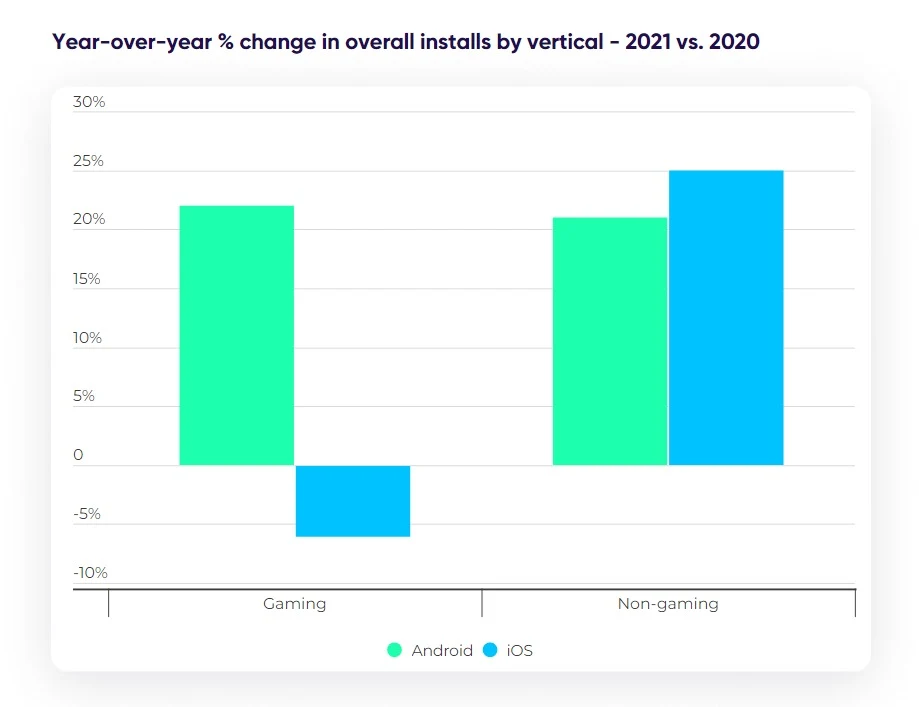

Following the Application Tracking Transparency approach by Apple, gaming advertisers failed to quantify upgrades, according to the research. As per the statistics revealed by specialists, the number of downloaded games on Android increased by 22% the previous year.

Moreover, the use of Apple's SKAdNetwork increased by more than 5 times, in the combination of unique plus enhanced tracking facilities, the overall count of NOIs approached pre-iOS 14.5 plus ranges. Furthermore, gaming applications have embraced SKAN quickly compared to non-gaming ones, with 67% of apple non-organic downloads from SKAN versus just 30% in various disciplines. The previous year, advertisers spent $14.5 billion in applications based on gaming client engagement, with the United States accounting for 50% of the whole. 21% and 25% rise of non-gaming applications for Apple and Android, respectively, indicates advertisers' strong dependency on client-based information. Advertising spending on Android increased by 35%. The lack of statistics to quantify gaming app downloads on iOS caused a 6% decrease.

Since June, after iOS 14.5 gained traction, total in-app purchase earnings in games have dropped by 35%, globally. The large drop in IAP revenue highlights the advertising issue for games in the era of privacy, whereas Android usage stayed stable and perhaps even increased by 10% by the end of 2021.

However, in the United States, the fourth-quarter rate of downloading games has increased by 10% and then by 30% from September to December. In Q4 2022, Apple and Android have both seen a significant gain in average installations.

In the UK, game downloads fell 18% from September to November the year before, then increased up 28% in December.

Hard-core and hyper-casual games both saw increases of 62% on Android (29% Apple) and 26% on Android (6% Apple), respectively.

In-app sales remained considerably popular for hardcore games (+17 %), and in-application advertisement profits doubled for games for most of 2021.

AppsFlyer's Head of Gaming, Brian Murphy, stated that as additional sites add data use limitations, the private information of users will keep improving. In 2022, game advertisers should concentrate on interaction.

In a nutshell, the game advertisers wishing to succeed in 2022, should have a complete emphasis on ads display, web traffic control, and reconsidering tracking of KPIs on the list.

Read next: Apple’s App Store users are way ahead of Google Play users in terms of spending subscription money

Statistics competence is well-known among gaming application developers. Last month, The State of Gaming App Marketing for 2022, was published by AppsFlyer. It is detailed research on important game trends that will support advertisers with developing new techniques & eventually mastering the fresh period of cybersecurity.

Following the Application Tracking Transparency approach by Apple, gaming advertisers failed to quantify upgrades, according to the research. As per the statistics revealed by specialists, the number of downloaded games on Android increased by 22% the previous year.

Moreover, the use of Apple's SKAdNetwork increased by more than 5 times, in the combination of unique plus enhanced tracking facilities, the overall count of NOIs approached pre-iOS 14.5 plus ranges. Furthermore, gaming applications have embraced SKAN quickly compared to non-gaming ones, with 67% of apple non-organic downloads from SKAN versus just 30% in various disciplines. The previous year, advertisers spent $14.5 billion in applications based on gaming client engagement, with the United States accounting for 50% of the whole. 21% and 25% rise of non-gaming applications for Apple and Android, respectively, indicates advertisers' strong dependency on client-based information. Advertising spending on Android increased by 35%. The lack of statistics to quantify gaming app downloads on iOS caused a 6% decrease.

Since June, after iOS 14.5 gained traction, total in-app purchase earnings in games have dropped by 35%, globally. The large drop in IAP revenue highlights the advertising issue for games in the era of privacy, whereas Android usage stayed stable and perhaps even increased by 10% by the end of 2021.

However, in the United States, the fourth-quarter rate of downloading games has increased by 10% and then by 30% from September to December. In Q4 2022, Apple and Android have both seen a significant gain in average installations.

In the UK, game downloads fell 18% from September to November the year before, then increased up 28% in December.

Hard-core and hyper-casual games both saw increases of 62% on Android (29% Apple) and 26% on Android (6% Apple), respectively.

In-app sales remained considerably popular for hardcore games (+17 %), and in-application advertisement profits doubled for games for most of 2021.

AppsFlyer's Head of Gaming, Brian Murphy, stated that as additional sites add data use limitations, the private information of users will keep improving. In 2022, game advertisers should concentrate on interaction.

In a nutshell, the game advertisers wishing to succeed in 2022, should have a complete emphasis on ads display, web traffic control, and reconsidering tracking of KPIs on the list.

Read next: Apple’s App Store users are way ahead of Google Play users in terms of spending subscription money