Corporate tax rates have been falling for over 40 years, and many people think it's time for a change. And we could be about to see it. In July 2021, 130 nations backed a global minimum corporate tax of 15%.

But how much difference would this really make?

Small business finance provider OnDeck decided to investigate. Using data collected from KPMG, the Tax Foundation, and various government websites, it applied each country's tax laws to a model company to see how much tax companies are currently paying across the globe.

Here's what they find out

Europe is a great place to do business, especially for start-ups or young entrepreneurs. It takes less than two weeks to incorporate a new company in Europe, and the continent has some of the most competitive business tax rates in the world.

Small businesses operating in Europe pay around 17.9% in corporate tax; that's the lowest rate in the world outside of the Middle East and Central Asia. It's one of the main reasons why several smaller European nations are becoming global startup hubs. Thanks to a generous tax rate of just 12.9%, Cyprus has the third most new company registrations per year.

By global standards, 12.9% is low. But it's nowhere near as low as the corporate tax rate in Monaco. Companies based in the billionaire's playground pay 0% tax. But there is a catch; to qualify for this tax exemption, companies must earn at least 75% of their revenue from business done within Monaco's borders.

Corporations in high tax states like New Jersey are subject to double-digit tax rates. Businesses in North Carolina, Missouri, and Oklahoma pay less than 5% of their profits to the Inland Revenue Service.

Depending on your political persuasion, things get even better (or worse) for businesses located in Delaware. It's been an internal tax haven since the 19th-century. Delaware has no value-added taxes (VATs), no inheritance tax, no capital shares or stock transfer taxes, and a 'business friendly' corporation tax of 0%.

Approximately 1,000,000 businesses have their corporate headquarters in this small Mid-Atlantic U.S. state, including 67% of Fortune 500 companies. This is due to what commentators (and critics) call the Delaware loophole. It's a piece of state legislation that allows huge corporations to declare certain types of revenue in the state where the company is incorporated rather than in the states where they operate.

High levels of bureaucracy (combined with pockets of corruption) is another reason why South America isn't the most business-friendly place on the planet. It can take over 40 days to incorporate a new business, and start-up costs work out at 41.4% of gross national income per capita.

Suriname has the highest corporate tax rate on the continent; it's 36.0%. And it doesn't look like small businesses will drive economic recovery in Venezuela anytime soon. In addition to operating in a collapsing economy, business owners must cope with a steep corporate tax rate of 34%. And those who want to start a new business need to pay out more than twice their annual salary in set-up costs and other administration fees.

But things are much easier for business owners in the continent's southern nations. Chile and Uruguay have some of the lowest corporate tax rates in South America, and those operating in Paraguay pay just 10%.

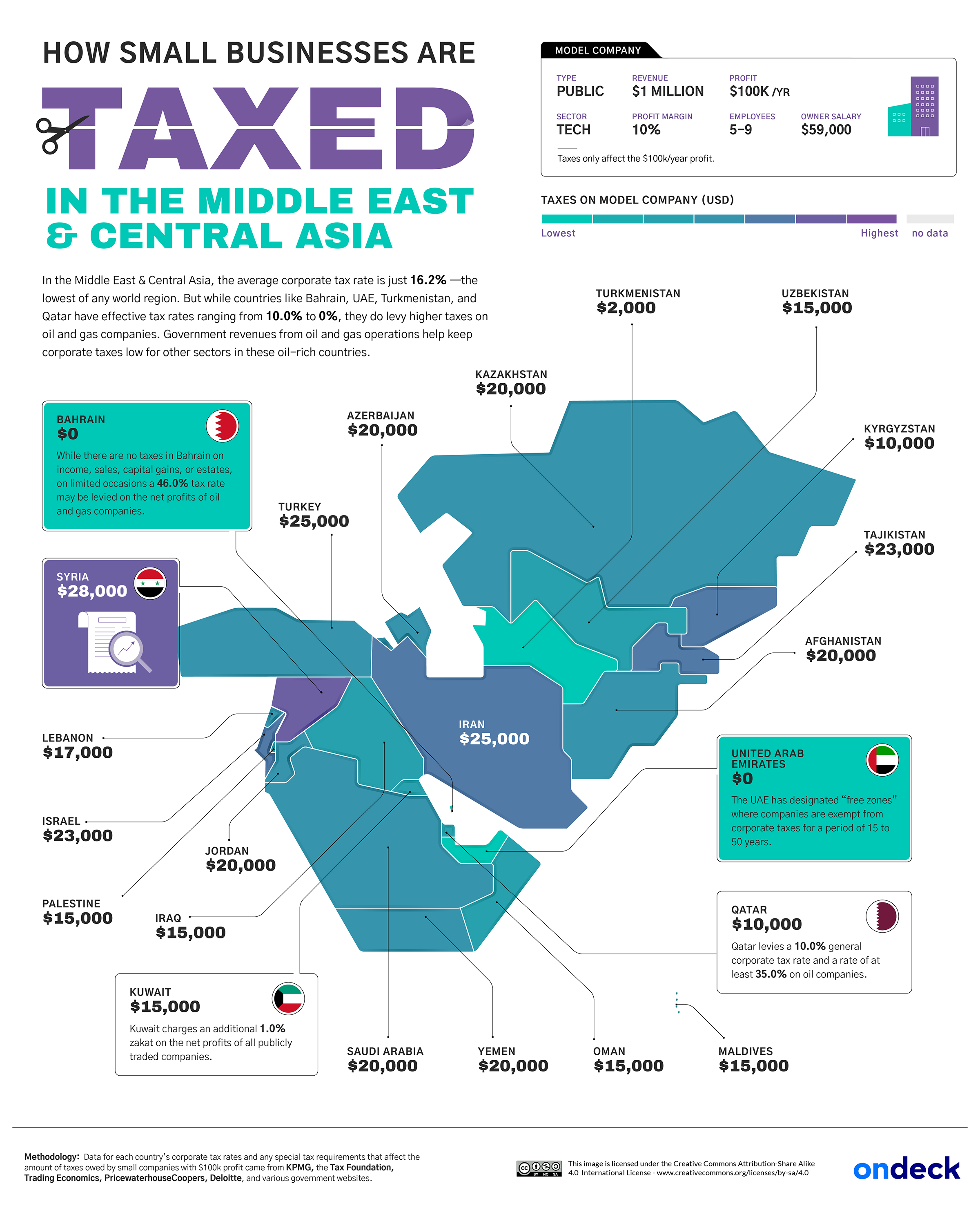

Corporate taxes tend to be lower in countries with significant natural resources, including Turkemenstain, Qatar, and Kazakhstan. Their governments collect vast amounts of revenue from the oil and gas industries, which allows them to provide generous tax breaks for companies outside of these sectors. For example, companies not operating in Bahrain's or the UAE's oil and gas sectors pay 0% corporation tax.

Companies located in Turkey, Iran, and Syria have to set aside 25% of their annual profits for corporate taxes.

On the lower end of the scale, we find countries including Vanuatu and Naura. Their tax laws mean businesses are effectively exempt from taxes on their profits. But the 0% rate has nothing to do with trying to attract large corporations to these small islands. Instead, it reflects their libertarian ideals that value individual freedom and self-sufficiency.

Vanuatu and Naura are very much the exceptions. The corporate tax map shows that most nations in Oceania and the rest of Asia have a flat corporate tax rate of 30%. It's a little higher in Japan, where the tax rate is 36%.

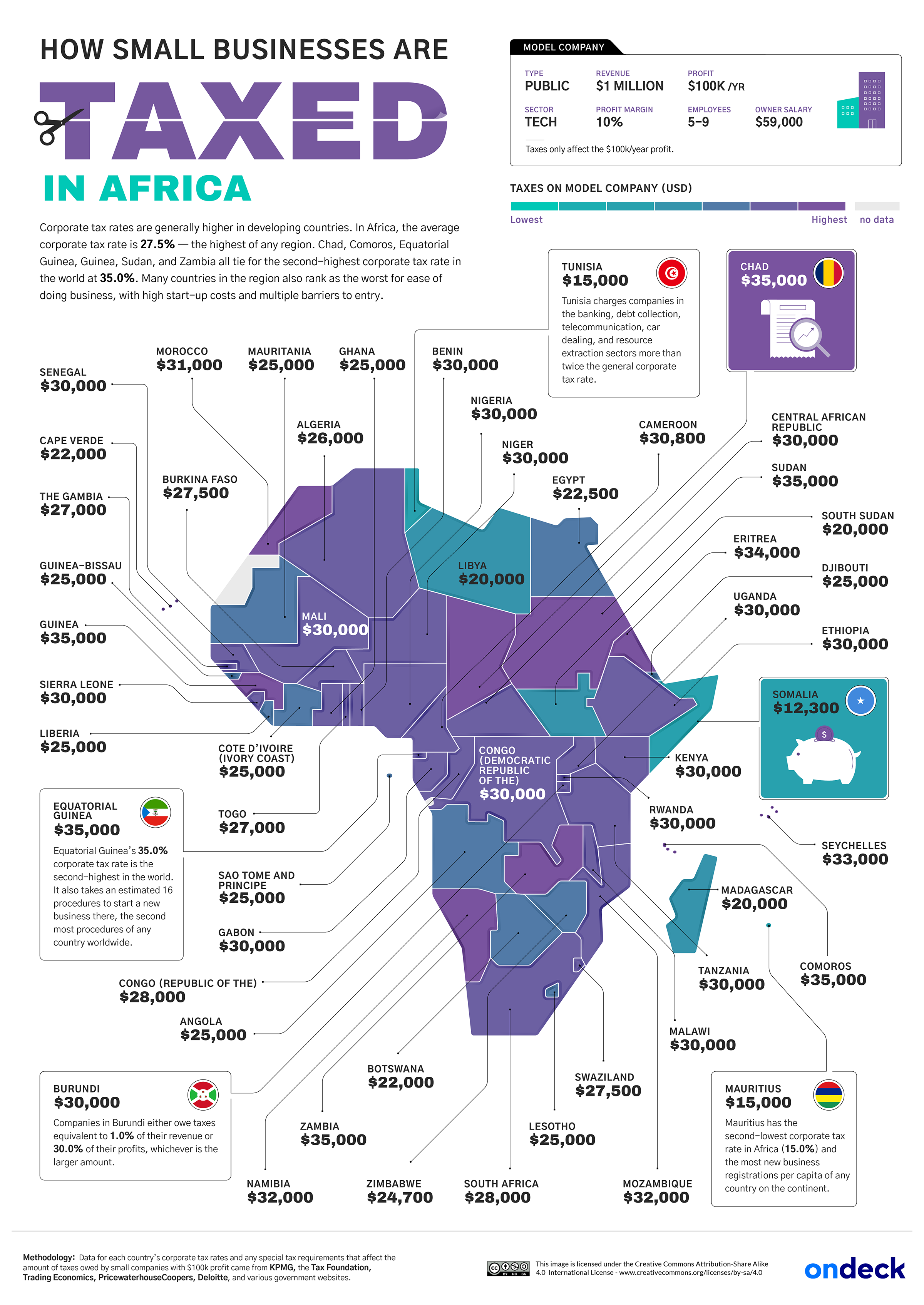

That figure is even higher in Zambia, Chad, and Sudan, where business owners are taxed an eye-watering 35%. Somalian corporations get a much better deal; the effective corporate tax rate in Somalia is just 12.3%.

The proposed minimum tax rate of 15% will undoubtedly impact the mega-corporations that set up headquarters in global tax-havens. But for now, the proposal is little more than talk. We'll have to wait and see if it ever translates into real action.

Read next: The Majority of Cyber Attacks in 2021 Targeted Educational and Government Institutions

But how much difference would this really make?

Small business finance provider OnDeck decided to investigate. Using data collected from KPMG, the Tax Foundation, and various government websites, it applied each country's tax laws to a model company to see how much tax companies are currently paying across the globe.

Here's what they find out

Europe's small business tax

Europe is a great place to do business, especially for start-ups or young entrepreneurs. It takes less than two weeks to incorporate a new company in Europe, and the continent has some of the most competitive business tax rates in the world.Small businesses operating in Europe pay around 17.9% in corporate tax; that's the lowest rate in the world outside of the Middle East and Central Asia. It's one of the main reasons why several smaller European nations are becoming global startup hubs. Thanks to a generous tax rate of just 12.9%, Cyprus has the third most new company registrations per year.

By global standards, 12.9% is low. But it's nowhere near as low as the corporate tax rate in Monaco. Companies based in the billionaire's playground pay 0% tax. But there is a catch; to qualify for this tax exemption, companies must earn at least 75% of their revenue from business done within Monaco's borders.

How businesses are taxed in North America

Tax is a complicated business in the USA. The country's state system means business tax rates vary dramatically. So while the national average is 25.6%, the amount individual corporations actually pay depends on where they make their money.Corporations in high tax states like New Jersey are subject to double-digit tax rates. Businesses in North Carolina, Missouri, and Oklahoma pay less than 5% of their profits to the Inland Revenue Service.

Depending on your political persuasion, things get even better (or worse) for businesses located in Delaware. It's been an internal tax haven since the 19th-century. Delaware has no value-added taxes (VATs), no inheritance tax, no capital shares or stock transfer taxes, and a 'business friendly' corporation tax of 0%.

Approximately 1,000,000 businesses have their corporate headquarters in this small Mid-Atlantic U.S. state, including 67% of Fortune 500 companies. This is due to what commentators (and critics) call the Delaware loophole. It's a piece of state legislation that allows huge corporations to declare certain types of revenue in the state where the company is incorporated rather than in the states where they operate.

Corporate tax in South America

The average corporate tax rate in South America is 26.1%; that's the highest figure of any continent.High levels of bureaucracy (combined with pockets of corruption) is another reason why South America isn't the most business-friendly place on the planet. It can take over 40 days to incorporate a new business, and start-up costs work out at 41.4% of gross national income per capita.

Suriname has the highest corporate tax rate on the continent; it's 36.0%. And it doesn't look like small businesses will drive economic recovery in Venezuela anytime soon. In addition to operating in a collapsing economy, business owners must cope with a steep corporate tax rate of 34%. And those who want to start a new business need to pay out more than twice their annual salary in set-up costs and other administration fees.

But things are much easier for business owners in the continent's southern nations. Chile and Uruguay have some of the lowest corporate tax rates in South America, and those operating in Paraguay pay just 10%.

Taxing small businesses in the Middle East and Central Asia

The Middle East and Central Asia have the lowest average corporate tax rate globally (16.2%). But given the size of the region, it's no surprise that the figures vary dramatically from country to country.Corporate taxes tend to be lower in countries with significant natural resources, including Turkemenstain, Qatar, and Kazakhstan. Their governments collect vast amounts of revenue from the oil and gas industries, which allows them to provide generous tax breaks for companies outside of these sectors. For example, companies not operating in Bahrain's or the UAE's oil and gas sectors pay 0% corporation tax.

Companies located in Turkey, Iran, and Syria have to set aside 25% of their annual profits for corporate taxes.

Corporation taxes across Oceania and the rest of Asia

With almost five billion people and over 2,000 recognized languages, Asia is one of the most diverse areas on earth. And its corporate tax rates are equally varied. In fact, corporate tax rates vary more in this region than anywhere else.On the lower end of the scale, we find countries including Vanuatu and Naura. Their tax laws mean businesses are effectively exempt from taxes on their profits. But the 0% rate has nothing to do with trying to attract large corporations to these small islands. Instead, it reflects their libertarian ideals that value individual freedom and self-sufficiency.

Vanuatu and Naura are very much the exceptions. The corporate tax map shows that most nations in Oceania and the rest of Asia have a flat corporate tax rate of 30%. It's a little higher in Japan, where the tax rate is 36%.

Taxing small businesses in Africa

Despite being home to some of today's fastest-growing economies, Africa is the least competitive continent in terms of corporate tax rates. On average, it works out at over 27%; that means over a quarter of profits go into government hands.That figure is even higher in Zambia, Chad, and Sudan, where business owners are taxed an eye-watering 35%. Somalian corporations get a much better deal; the effective corporate tax rate in Somalia is just 12.3%.

The proposed minimum tax rate of 15% will undoubtedly impact the mega-corporations that set up headquarters in global tax-havens. But for now, the proposal is little more than talk. We'll have to wait and see if it ever translates into real action.

Read next: The Majority of Cyber Attacks in 2021 Targeted Educational and Government Institutions