A study conducted by Beyond Identity reveals that password troubles may be costing businesses a notable loss in online business transactions.

Passwords are a difficult topic to navigate oneself around online, I will admit. Sure, from the perspective of a customer there’s not really all that much to it: just choose a name and keep adding whatever symbols, uppercases, or numbers the platform asks of you until the password gets accepted. As a matter of fact, most individuals find this entire process to be all-too tedious and unnecessary. It’s an inconvenience when a platform states that your password wasn’t sufficient, it’s an annoyance to come up with yet another password, and it’s a pain to then remember that password when it comes up again. However, from the perspective of the individuals who run said platforms, maintaining a medium of security is paramount. While customers are always displeased with filling up long passwords, they’re even unhappier with cybercriminals brute-forcing an easy password and using their credentials for no good. However, data seems to suggest that the extra level of care that businesses with online outlets are putting into their password protection is leading to a net loss of revenue.

Beyond Identity is a cybersecurity firm geared around online identity management, and its study was aimed at password resets, and how much they affect online transactions. The firm got about to work by surveying 1,019 US residents, with a widespread age group consisting of baby boomers, millennials, gen X, and gen Z. Gen Z formed the smallest part of the age group, considering that the youngest of these age groups were also the least likely to make online transactions using their own passwords or credit card information. With the methodology and parameters established, let’s get to work discussing what insight Beyond Identity offered into the average online consumer’s mindset.

To start off, people hate using a password so much that they’ll attempt to forego making an account on new platforms in the first place. Over half of the sample population stated that they would actively rely on pre-existing online credentials (Google, Facebook, Twitter, etc.) to log onto a new platform if it were allowed for. Half of the participants also reported that they would leave a site if it required signing in with a newly made password. Now that’s half of one’s potential audience already scattered to the wind owing to password practices. However, there’s the audience that’s signed up to consider now, and whether or not they decide to stick around for more password-related security protocols; quick spoiler, they don’t.

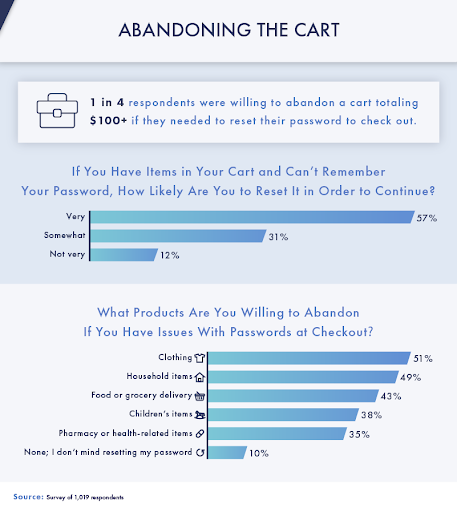

One in every four individuals of our sample population would willingly abandon a USD $100+ online cart if checking out required their password to be reset. This does have its limits, however, as the survey’s participants did not go beyond USD $162 for what they considered worth abandoning. Which is still a lot of profit that’s being lost, however, considering that one fourth of the sample population is committed to this. A big reason for this reluctance could also be due to a very clear inability to remember or store passwords; nearly half of the survey’s respondents admitted to resetting bill-payment passwords once a year due to forgetfulness. Baby boomers were found more likely than any age group to keep reusing old passwords in order to remember them. Overall, even when security protocols are being followed, they were found to be circumvented or undercut in some way or another.

Ultimately, it must all boil down to raised awareness regarding the importance of password security. Nowadays, password managers can help users with any number of passwords, and even generate complex ones to keep brute force cybercriminals guessing. Businesses can’t be blamed for trying to keep their clients secure, even as those very clients undermine such attempts. Check out the graphics below for more insights:

Read next: The Amount of Crypto That Was Stolen in the Past Decade Will Shock You

Passwords are a difficult topic to navigate oneself around online, I will admit. Sure, from the perspective of a customer there’s not really all that much to it: just choose a name and keep adding whatever symbols, uppercases, or numbers the platform asks of you until the password gets accepted. As a matter of fact, most individuals find this entire process to be all-too tedious and unnecessary. It’s an inconvenience when a platform states that your password wasn’t sufficient, it’s an annoyance to come up with yet another password, and it’s a pain to then remember that password when it comes up again. However, from the perspective of the individuals who run said platforms, maintaining a medium of security is paramount. While customers are always displeased with filling up long passwords, they’re even unhappier with cybercriminals brute-forcing an easy password and using their credentials for no good. However, data seems to suggest that the extra level of care that businesses with online outlets are putting into their password protection is leading to a net loss of revenue.

Beyond Identity is a cybersecurity firm geared around online identity management, and its study was aimed at password resets, and how much they affect online transactions. The firm got about to work by surveying 1,019 US residents, with a widespread age group consisting of baby boomers, millennials, gen X, and gen Z. Gen Z formed the smallest part of the age group, considering that the youngest of these age groups were also the least likely to make online transactions using their own passwords or credit card information. With the methodology and parameters established, let’s get to work discussing what insight Beyond Identity offered into the average online consumer’s mindset.

To start off, people hate using a password so much that they’ll attempt to forego making an account on new platforms in the first place. Over half of the sample population stated that they would actively rely on pre-existing online credentials (Google, Facebook, Twitter, etc.) to log onto a new platform if it were allowed for. Half of the participants also reported that they would leave a site if it required signing in with a newly made password. Now that’s half of one’s potential audience already scattered to the wind owing to password practices. However, there’s the audience that’s signed up to consider now, and whether or not they decide to stick around for more password-related security protocols; quick spoiler, they don’t.

One in every four individuals of our sample population would willingly abandon a USD $100+ online cart if checking out required their password to be reset. This does have its limits, however, as the survey’s participants did not go beyond USD $162 for what they considered worth abandoning. Which is still a lot of profit that’s being lost, however, considering that one fourth of the sample population is committed to this. A big reason for this reluctance could also be due to a very clear inability to remember or store passwords; nearly half of the survey’s respondents admitted to resetting bill-payment passwords once a year due to forgetfulness. Baby boomers were found more likely than any age group to keep reusing old passwords in order to remember them. Overall, even when security protocols are being followed, they were found to be circumvented or undercut in some way or another.

Ultimately, it must all boil down to raised awareness regarding the importance of password security. Nowadays, password managers can help users with any number of passwords, and even generate complex ones to keep brute force cybercriminals guessing. Businesses can’t be blamed for trying to keep their clients secure, even as those very clients undermine such attempts. Check out the graphics below for more insights:

Read next: The Amount of Crypto That Was Stolen in the Past Decade Will Shock You