Recently, Sift presented its Digital Trust and Safety Index through a survey of more than 34,000 applications and websites and around 1,000 customers as respondents. This research shed light on different types of cybercrimes, but most importantly in the Account Takeover fraud attacks which have been on a rise for a couple of years but saw a major spike in 2019 and caused losses of more than $16.9 billion to consumers and online retailers in different industries.

According to Sift’s index, ATO fraud attacks have especially spiked by almost 282% from the second quarter of 2019 till the second quarter of 2020. And further exacerbation happened because of the COVID-19 pandemic, which prompted people more towards e-commerce for contactless shopping. Since there were implementations of lockdowns and other safety measures, people resorted more towards online shopping and this further exposed them to the attackers and perpetrators of ATO fraud attacks, which increased by almost 300% during this period.

The COVID-19 pandemic has made the online retail activity more prone to get attacked by cybercriminals now. According to Sift’s report, retailers unintentionally make themselves more susceptible to become a target of such attacks by introducing ‘One-click’ and ‘On-demand’ types of solutions to make the shopping experience easier for their customers. But inadvertently, they are exposing their customers to these attackers and making their customer data more easily accessible through these measures.

In an ATO attack, cybercriminals use automated bots to access the web, use stolen credentials from consumers and enter them into their online accounts. These attackers are always looking for ways to crack in different security codes and passwords that people use to protect their accounts.

Now, online retailers are trying to make online shopping easy, so while they introduce easier solutions, they also try to put different barriers to protect their customers from fraudulent activities. Using tools like the two-factor and multifactor authentication, different biometrics systems, CAPTCHA codes, etc. But unfortunately, people get irritated and frustrated and find these protection tools as a huge hindrance in their seam-less shopping experience. So, they either abandon their carts and move onto some other online retailer, or they keep entering their sensitive credentials, which in return, make them more susceptible to become a target of cybercrime.

So, it seems to be a vicious cycle, and the way these cybercriminals have evolved into properly well-funded organizations of hackers and actors; avoiding cybercrime or becoming the target of cybercrime just seems impossible.

And these attackers are attacking everywhere, on all kinds of sites and applications. So, no place over the internet is safe. But the most affected sites are those that are selling physical goods. Physical e-commerce marketplaces have seen a rise in ATO fraud attacks by more than 378%. These attackers steal credentials from customers, then use them to buy physical goods online, pick them up later, and then return them to resell, of course with huge amounts of profit!

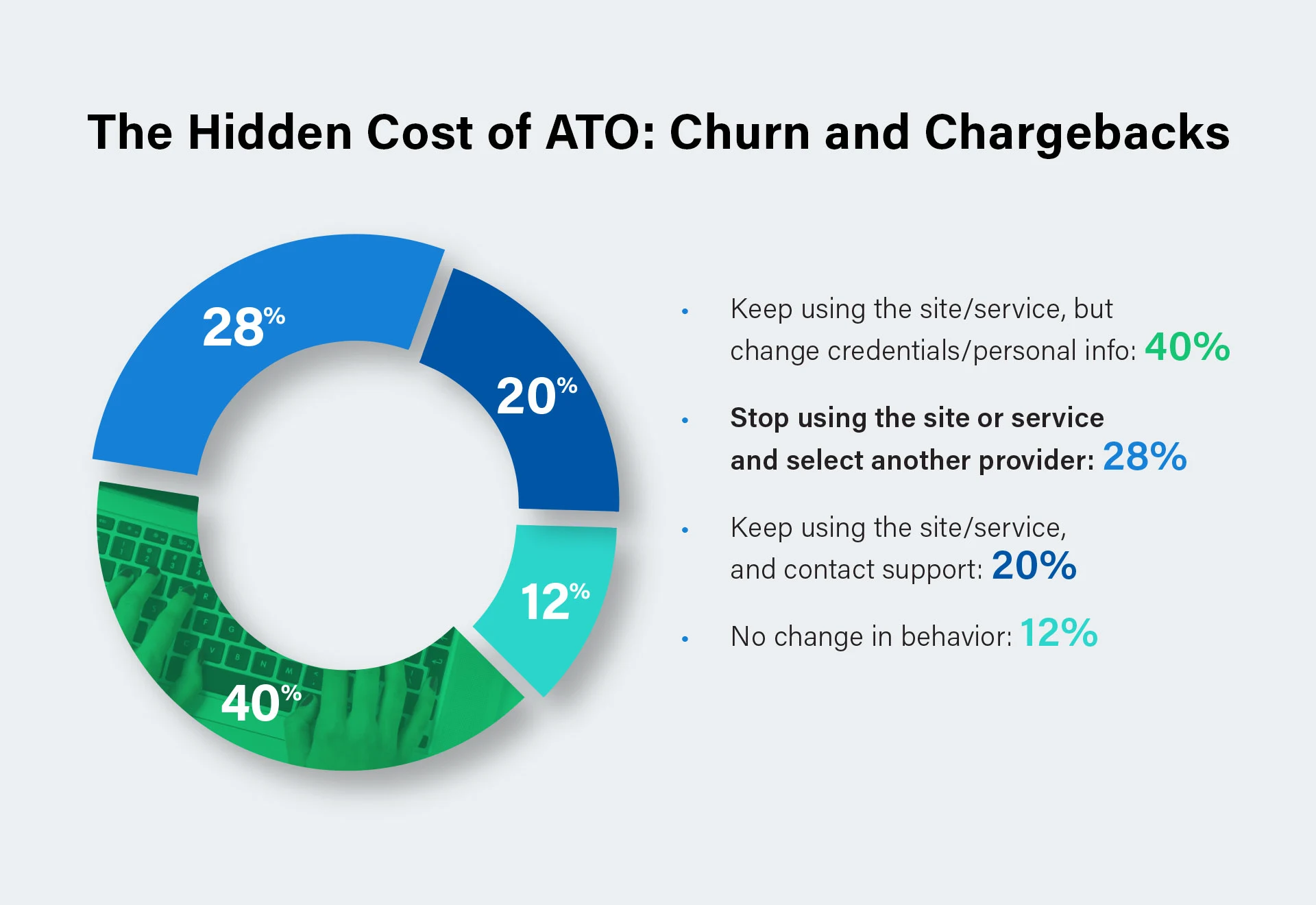

These attacks have an impact on brand loyalty also because almost 56% of the respondents of this survey said that they would promptly switch to another site or online retailer if they find out that their credentials and personal information have all been compromised.

According to Sift’s index, ATO fraud attacks have especially spiked by almost 282% from the second quarter of 2019 till the second quarter of 2020. And further exacerbation happened because of the COVID-19 pandemic, which prompted people more towards e-commerce for contactless shopping. Since there were implementations of lockdowns and other safety measures, people resorted more towards online shopping and this further exposed them to the attackers and perpetrators of ATO fraud attacks, which increased by almost 300% during this period.

The COVID-19 pandemic has made the online retail activity more prone to get attacked by cybercriminals now. According to Sift’s report, retailers unintentionally make themselves more susceptible to become a target of such attacks by introducing ‘One-click’ and ‘On-demand’ types of solutions to make the shopping experience easier for their customers. But inadvertently, they are exposing their customers to these attackers and making their customer data more easily accessible through these measures.

In an ATO attack, cybercriminals use automated bots to access the web, use stolen credentials from consumers and enter them into their online accounts. These attackers are always looking for ways to crack in different security codes and passwords that people use to protect their accounts.

Now, online retailers are trying to make online shopping easy, so while they introduce easier solutions, they also try to put different barriers to protect their customers from fraudulent activities. Using tools like the two-factor and multifactor authentication, different biometrics systems, CAPTCHA codes, etc. But unfortunately, people get irritated and frustrated and find these protection tools as a huge hindrance in their seam-less shopping experience. So, they either abandon their carts and move onto some other online retailer, or they keep entering their sensitive credentials, which in return, make them more susceptible to become a target of cybercrime.

So, it seems to be a vicious cycle, and the way these cybercriminals have evolved into properly well-funded organizations of hackers and actors; avoiding cybercrime or becoming the target of cybercrime just seems impossible.

And these attackers are attacking everywhere, on all kinds of sites and applications. So, no place over the internet is safe. But the most affected sites are those that are selling physical goods. Physical e-commerce marketplaces have seen a rise in ATO fraud attacks by more than 378%. These attackers steal credentials from customers, then use them to buy physical goods online, pick them up later, and then return them to resell, of course with huge amounts of profit!

These attacks have an impact on brand loyalty also because almost 56% of the respondents of this survey said that they would promptly switch to another site or online retailer if they find out that their credentials and personal information have all been compromised.