The digital payments landscape has undergone a structural shift during the last ten years. The digital payments ecosystem continues to grow as a solution of choice for millions of users every year. The coronavirus pandemic has also accelerated the digital payment adoption.

First, we will discuss the origins of digital payments. 25 years ago, a 21-year-old entrepreneur Dan Kohn in Nashua, New Hampshire sold a CD over the internet through credit card payment. This was the first digital payment transaction in history. In 1994, a CD was sold for $12.48 on NetMarket. This was the first online purchase, and then in 1997, Coca-Cola installed two vending machines in Helsinki that accept payments by text messages.

PayPal launched an electronic money transfer service back in the year 1999, and the user base grew approximately 10% daily. Elon Musk, CEO Tesla, and venture capitalist Peter Thiel were among the co-founders of this service. Then, Alibaba launched Alipay in China back in the year 2003.

In 2007, the first payment system for mobile was created by M-PESA which has more than 37 million active users across Africa. In 2009, Bitcoin enables secure and untraceable payments when Satoshi Nakamoto developed a decentralized payment system in the world.

WeChat rolled out WeChat Pay back in the year 2013, and it had over 800 million monthly active users back in the year 2018. In 2014, Apple Pay was launched, and it is expected that more than $2 trillion of smartphone payment transactions will be authenticated via biometric technology.

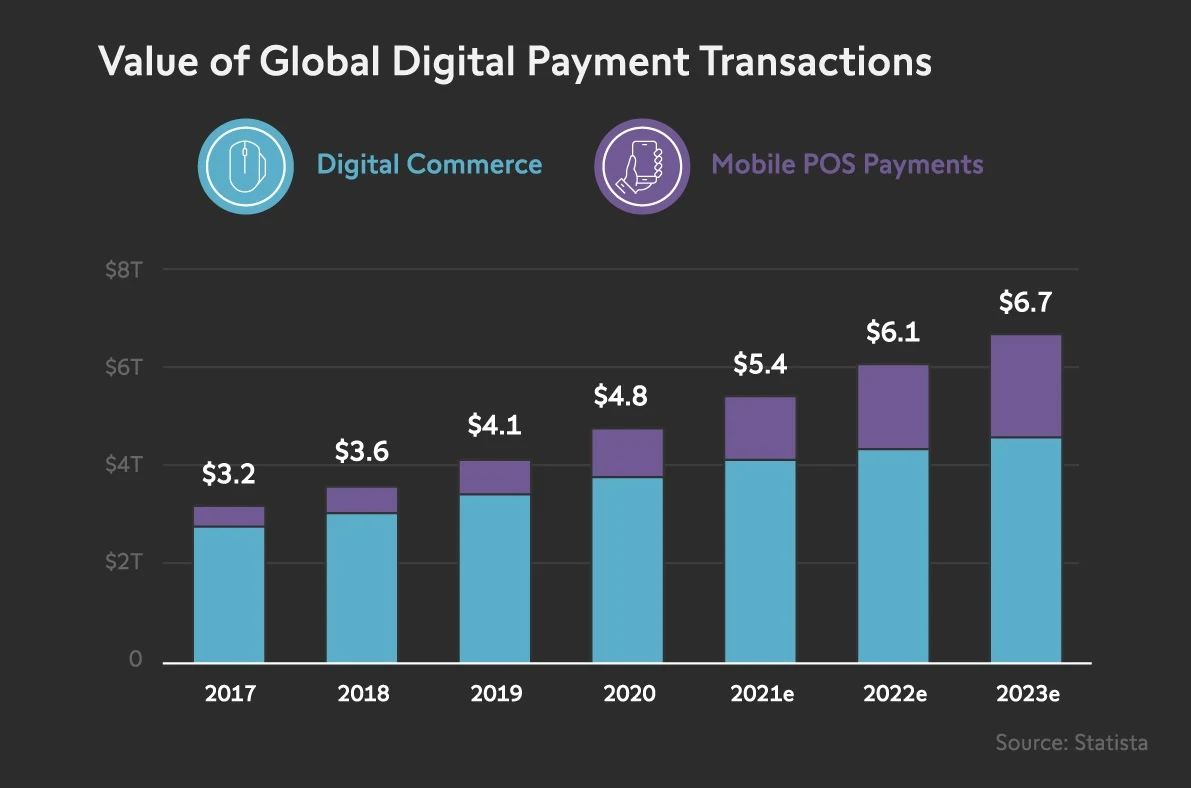

The sheer volume of the digital payment ecosystem has now surpassed the $4.1 trillion mark. Singapore is the region with the highest number of digital payments per person, with an average of 831 digital payments annually. Singapore’s e-commerce market is supported by high-speed and reliable internet and a young & tech-savvy population. It is expected that Sweden will become a cashless nation as early as 2023.

As digital transactions continue to rise, several other technological innovations may also be instrumental in shaping the evolution of this industry. The Payments feature in various messaging apps such as Messenger, WhatsApp, and WeChat can leverage the reach of billions of people across the globe. Moreover, Bank of America and Visa are investing in peer-to-peer partnerships, and more than 1 million cryptocurrency-transactions take place each day.

Mobile biometric security tools may also spur traction across cashless payments, and facial recognition may soon replace QR codes across transit, airports, and retail in China. According to experts, blockchain wallet users may reach 200 million by the year 2030. The $4.1 trillion digital payments industry is experiencing a notable transition that is catalyzed by a wave of worldwide advancements as well as disruption.

Take a look at this infographic for more insights:

Infographic courtesy of VC.

Read next: Are CryptoCurrencies The Future Of Finance?

First, we will discuss the origins of digital payments. 25 years ago, a 21-year-old entrepreneur Dan Kohn in Nashua, New Hampshire sold a CD over the internet through credit card payment. This was the first digital payment transaction in history. In 1994, a CD was sold for $12.48 on NetMarket. This was the first online purchase, and then in 1997, Coca-Cola installed two vending machines in Helsinki that accept payments by text messages.

PayPal launched an electronic money transfer service back in the year 1999, and the user base grew approximately 10% daily. Elon Musk, CEO Tesla, and venture capitalist Peter Thiel were among the co-founders of this service. Then, Alibaba launched Alipay in China back in the year 2003.

In 2007, the first payment system for mobile was created by M-PESA which has more than 37 million active users across Africa. In 2009, Bitcoin enables secure and untraceable payments when Satoshi Nakamoto developed a decentralized payment system in the world.

WeChat rolled out WeChat Pay back in the year 2013, and it had over 800 million monthly active users back in the year 2018. In 2014, Apple Pay was launched, and it is expected that more than $2 trillion of smartphone payment transactions will be authenticated via biometric technology.

The sheer volume of the digital payment ecosystem has now surpassed the $4.1 trillion mark. Singapore is the region with the highest number of digital payments per person, with an average of 831 digital payments annually. Singapore’s e-commerce market is supported by high-speed and reliable internet and a young & tech-savvy population. It is expected that Sweden will become a cashless nation as early as 2023.

As digital transactions continue to rise, several other technological innovations may also be instrumental in shaping the evolution of this industry. The Payments feature in various messaging apps such as Messenger, WhatsApp, and WeChat can leverage the reach of billions of people across the globe. Moreover, Bank of America and Visa are investing in peer-to-peer partnerships, and more than 1 million cryptocurrency-transactions take place each day.

Mobile biometric security tools may also spur traction across cashless payments, and facial recognition may soon replace QR codes across transit, airports, and retail in China. According to experts, blockchain wallet users may reach 200 million by the year 2030. The $4.1 trillion digital payments industry is experiencing a notable transition that is catalyzed by a wave of worldwide advancements as well as disruption.

Take a look at this infographic for more insights:

Infographic courtesy of VC.

Read next: Are CryptoCurrencies The Future Of Finance?