This rising post-millennial generation known as Gen Z is growing up fast. Understood as being made up of individuals born from 1997 to present, many of them are already older teens and even in college. Today, this massive demographic has a spending power anywhere between $29 billion and $143 billion and can only grow - but they are spending on their own terms.

Gen Z sees college as a means to an end, financially speaking of course. Whereas earlier generations may view their college education and experience as a social obligation or even expectation, Gen Zers simply don’t see it that way. When asked, 75% of Gen Zers say that college isn’t the only path to a good education, and 88% of 2017 graduates (which just happens to be the first Gen Z graduating class) say they chose their major with job availability in mind. Even during college, Gen Zers say they plan to save as much money as possible in those years. Reluctant to take out student loans and the subsequent and possible life-long debt that comes along with it, 66% plan to attend in-state universities over their “first-choice” schools, and 19% plan on living at home to save on living expenses. But these long-term financial goals didn’t just start in their college years; Gen Zers have been financially mindful since childhood, and planning for their future has always been top priority.

This frugal mindfulness translates well when Gen Zers enter college and later on in their professional careers. Again, choosing majors and paths of study that will carry them well into the future, the Gen Z work ethic doesn’t stop after graduation. Similar to most other generations, Gen Z looks for stable and high-income careers, the difference is however that they really aren’t afraid to make it happen. By graduation 78% of Gen Zers have already completed an internship or apprenticeship, 58% say they are willing to work nights and weekends, and a huge 75% say they are willing to even relocate to another state for a job offer. Solidifying themselves as valuable members of any professional team, Gen Z goes the extra mile not just for the employers, but for themselves also as 77% earn extra money through freelance work or part-time positions.

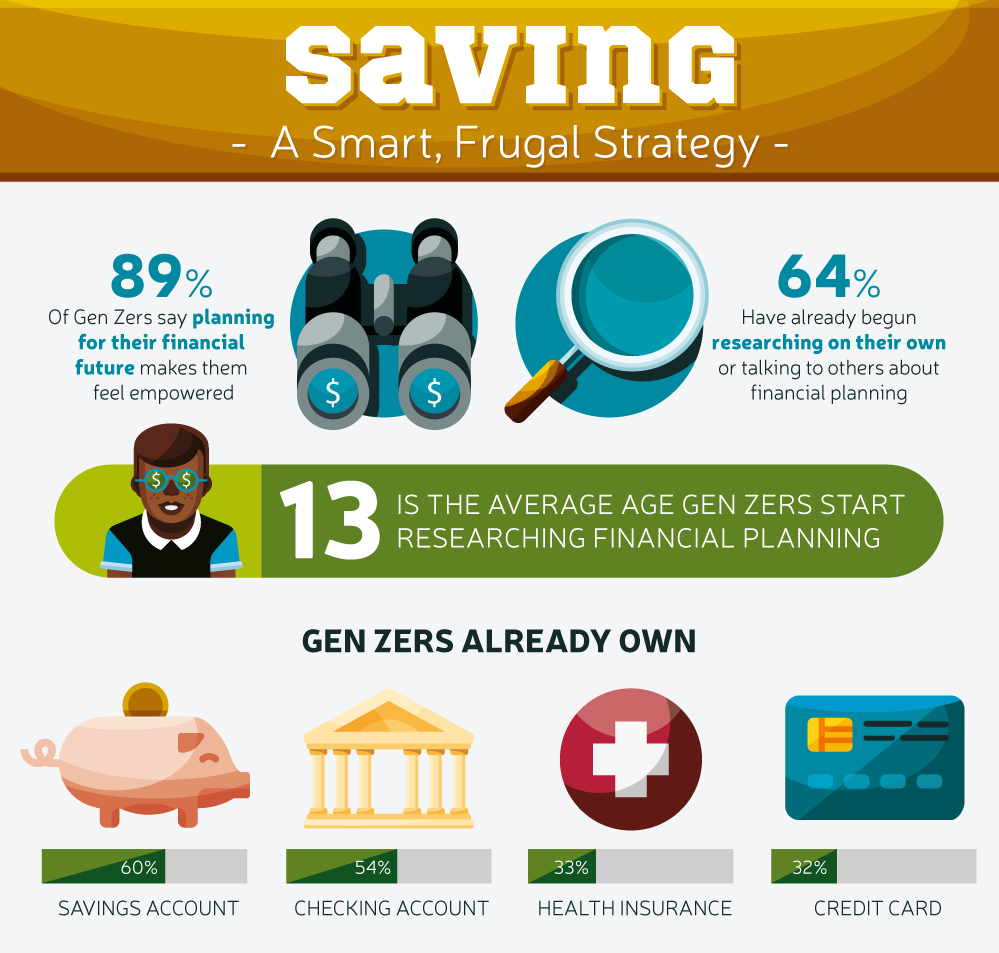

By 2020, not so far off now, Gen Z will make up 40% of consumers, but their attitudes toward finances have a very different perspective about things like careers and finances, informed by watching previous generations struggle. From watching their Gen X parents struggle during the Great Recession to seeing millennials racked with student loan debt, Gen Z though young in years, already understands the value of financial security and independence. Take a look at this infographic for a deeper look into the minds of Gen Zers, how they are shaping their own futures, and what lessons we can all take from their unique outlook.

Read next: Work-Life Balance in the Modern Era

Gen Z sees college as a means to an end, financially speaking of course. Whereas earlier generations may view their college education and experience as a social obligation or even expectation, Gen Zers simply don’t see it that way. When asked, 75% of Gen Zers say that college isn’t the only path to a good education, and 88% of 2017 graduates (which just happens to be the first Gen Z graduating class) say they chose their major with job availability in mind. Even during college, Gen Zers say they plan to save as much money as possible in those years. Reluctant to take out student loans and the subsequent and possible life-long debt that comes along with it, 66% plan to attend in-state universities over their “first-choice” schools, and 19% plan on living at home to save on living expenses. But these long-term financial goals didn’t just start in their college years; Gen Zers have been financially mindful since childhood, and planning for their future has always been top priority.

Related: Millennial Bashing Should End Now. Here’s Why [infographic]Before stepping through the halls of their chosen universities, and sometimes even before stepping into the halls of their local high schools, Gen Zers begin their financial planning. At 13, being the average age Gen Zers start researching for their financial plans and independence, 89% say that setting these plans in motion makes them feel empowered. Among millennials, 40% have overspent or even gone into debt just to keep up with their social lives, but Gen Z simply can’t relate. Almost 50% of Gen Zers use their phones in-store to check prices, research products, and consult with family and friends before making a purchase and 72% say that the cost of an item is the most important factor when making a purchase.

This frugal mindfulness translates well when Gen Zers enter college and later on in their professional careers. Again, choosing majors and paths of study that will carry them well into the future, the Gen Z work ethic doesn’t stop after graduation. Similar to most other generations, Gen Z looks for stable and high-income careers, the difference is however that they really aren’t afraid to make it happen. By graduation 78% of Gen Zers have already completed an internship or apprenticeship, 58% say they are willing to work nights and weekends, and a huge 75% say they are willing to even relocate to another state for a job offer. Solidifying themselves as valuable members of any professional team, Gen Z goes the extra mile not just for the employers, but for themselves also as 77% earn extra money through freelance work or part-time positions.

By 2020, not so far off now, Gen Z will make up 40% of consumers, but their attitudes toward finances have a very different perspective about things like careers and finances, informed by watching previous generations struggle. From watching their Gen X parents struggle during the Great Recession to seeing millennials racked with student loan debt, Gen Z though young in years, already understands the value of financial security and independence. Take a look at this infographic for a deeper look into the minds of Gen Zers, how they are shaping their own futures, and what lessons we can all take from their unique outlook.

Read next: Work-Life Balance in the Modern Era